Exhibit 99.2

Investor Presentation May 2020

Safe Harbor This presentation and the accompanying oral presentation contains information, statements,

beliefs and opinions which are forward-looking, and which reflect current estimates, expectations and projections about future events, referred to herein and which constitute “forward-looking statements” or “forward-looking information”

within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this document, regarding our strategy, future operations, financial position, prospects, plans and

objectives of management are forward-looking statements. Statements containing the words “could”, “believe”, “expect”, “intend”, “should”, “seek”, “anticipate”, “will”, “positioned”, “project”, “risk”, “plan”, “may”, “estimate” or, in each

case, their negative and words of similar meaning are intended to identify forward-looking statements. By their nature, forward-looking statements involve a number of known and unknown risks, uncertainties and assumptions, most of which are

difficult to predict and many of which are beyond the Company’s control, concerning, among other things, the Company’s anticipated business strategies, anticipated trends in the Company’s business and anticipated market share, that could

cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events

described herein. In addition, even if the outcome and financial effects of the plans and events described herein are consistent with the forward-looking statements contained in this document, those results or developments may not be

indicative of results or developments in subsequent periods. Although the Company has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in

forward-looking information, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. Forward-looking information contained in this document is based on the Company’s current

estimates, expectations and projections, which the Company believes are reasonable as of the current date. The Company can give no assurance that these estimates, expectations and projections will prove to have been correct. Given these

uncertainties, you should not place undue reliance on these forward-looking statements. All statements contained in this presentation are made only as of the date of this presentation, and the Company undertakes no duty to update this

information unless required by law. CANNABIS-RELATED ACTIVITIES ARE ILLEGAL UNDER U.S. FEDERAL LAWS: The U.S. Federal Controlled Substances Act classifies “marijuana” as a Schedule I controlled substance. Accordingly, cannabis-related

activities, including without limitation, the cultivation, manufacture, importation, possession, use or distribution of cannabis and cannabis products are illegal under U.S. federal law. Strict compliance with state and local laws with

respect to cannabis will neither absolve the Company of liability under U.S. federal law, nor will it provide a defense to any federal prosecution which may be brought against the Company with respect to adult-use or recreational cannabis.

Any such proceedings brought against the Company may adversely affect the Company’s operations and financial performance. Prospective investors should carefully consider the risk factors before investing directly or indirectly in the Company

and purchasing the securities described herein. 1

Executive Summary 2

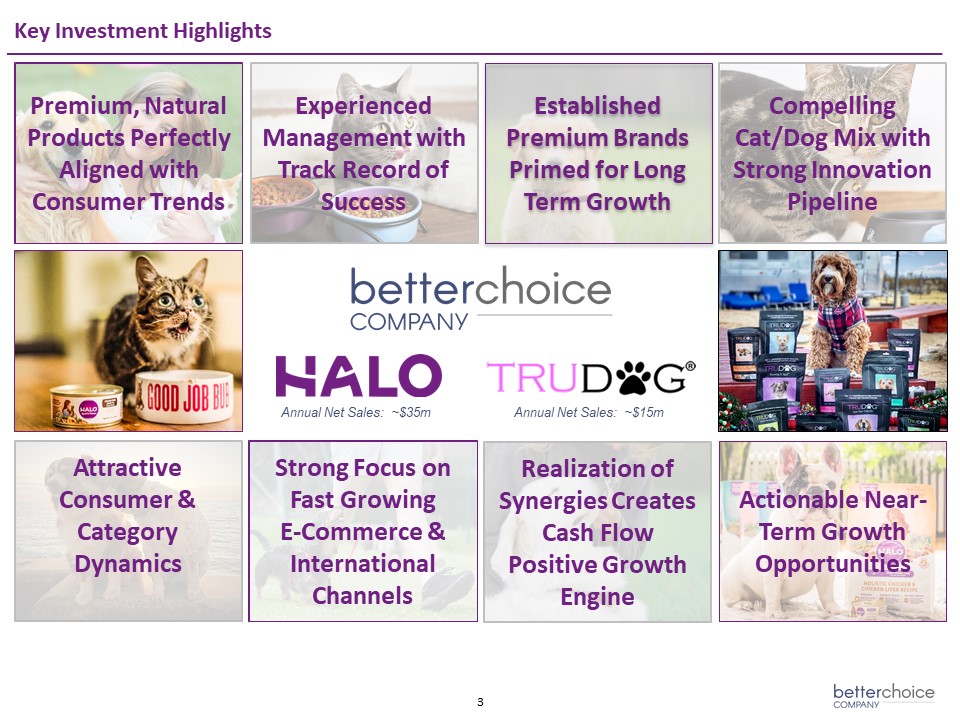

Strong Focus on Fast Growing E-Commerce & International Channels Premium, Natural Products

Perfectly Aligned with Consumer Trends Key Investment Highlights 3 Attractive Consumer & Category Dynamics Established Premium Brands Primed for Long Term Growth Realization of Synergies Creates Cash Flow Positive Growth

Engine Actionable Near-Term Growth Opportunities Compelling Cat/Dog Mix with Strong Innovation Pipeline Experienced Management with Track Record of Success Annual Net Sales: ~$35m Annual Net Sales: ~$15m

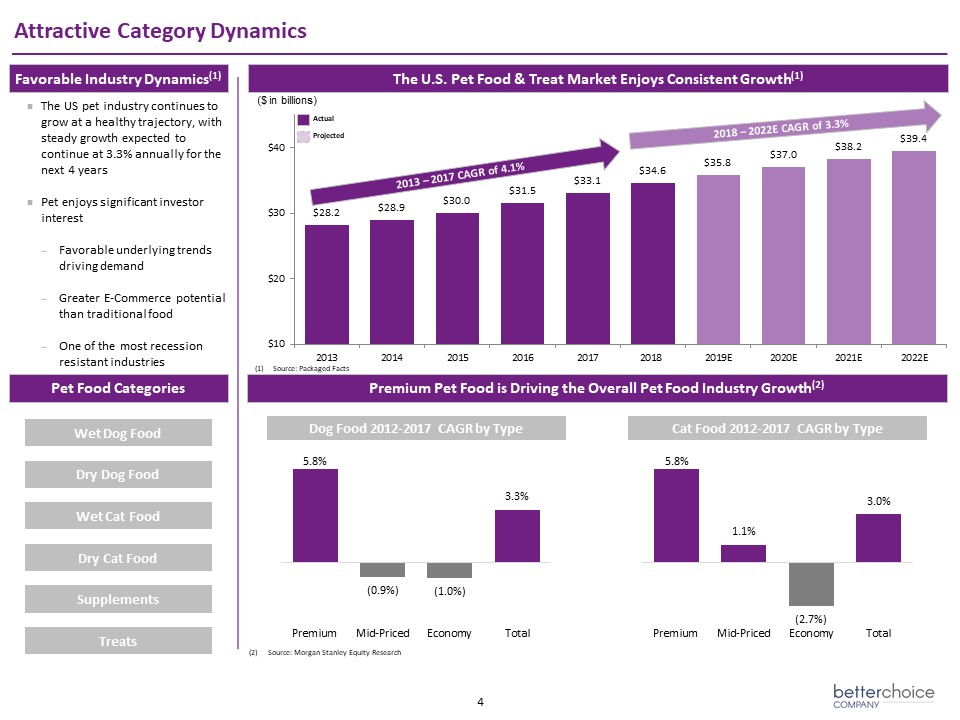

Attractive Category Dynamics (2) Source: Morgan Stanley Equity Research 4 The US pet industry

continues to grow at a healthy trajectory, with steady growth expected to continue at 3.3% annually for the next 4 yearsPet enjoys significant investor interest Favorable underlying trends driving demandGreater E-Commerce potential than

traditional foodOne of the most recession resistant industries ($ in billions) 2013 – 2017 CAGR of 4.1% 2018 – 2022E CAGR of 3.3% Least Recession Resistant Premium Pet Food is Driving the Overall Pet Food Industry Growth(2) The U.S. Pet

Food & Treat Market Enjoys Consistent Growth(1) Favorable Industry Dynamics(1) Wet Dog Food Dry Dog Food Wet Cat Food Supplements Dry Cat Food Pet Food Categories Dog Food 2012-2017 CAGR by Type Cat Food 2012-2017 CAGR by

Type Treats Projected Actual Source: Packaged Facts

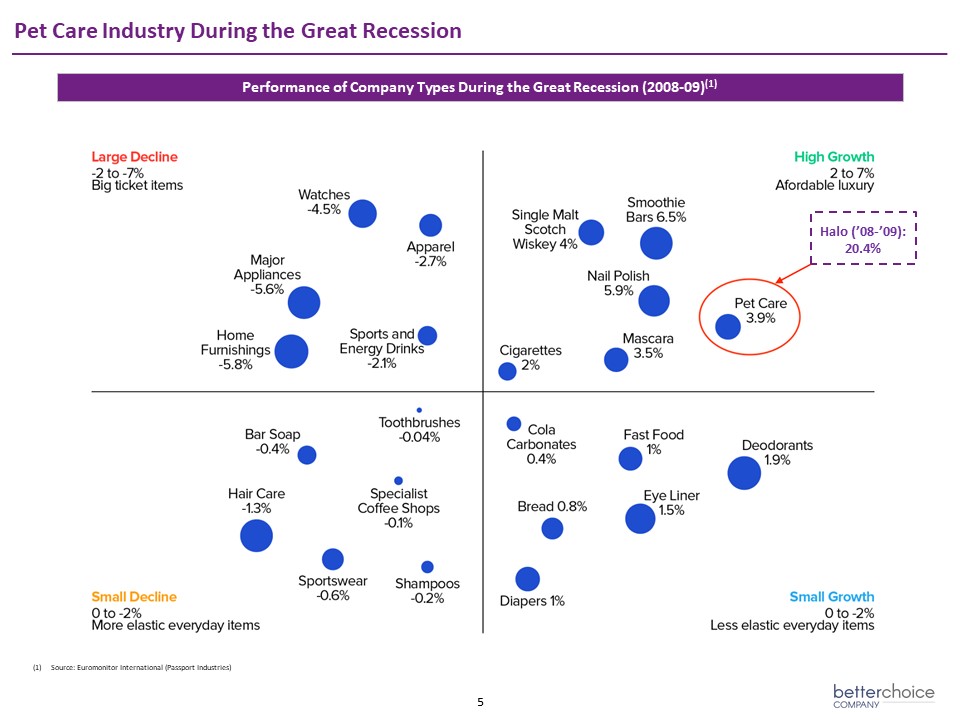

Pet Care Industry During the Great Recession Source: Euromonitor International (Passport

Industries) Performance of Company Types During the Great Recession (2008-09)(1) Halo (’08-’09): 20.4% 5

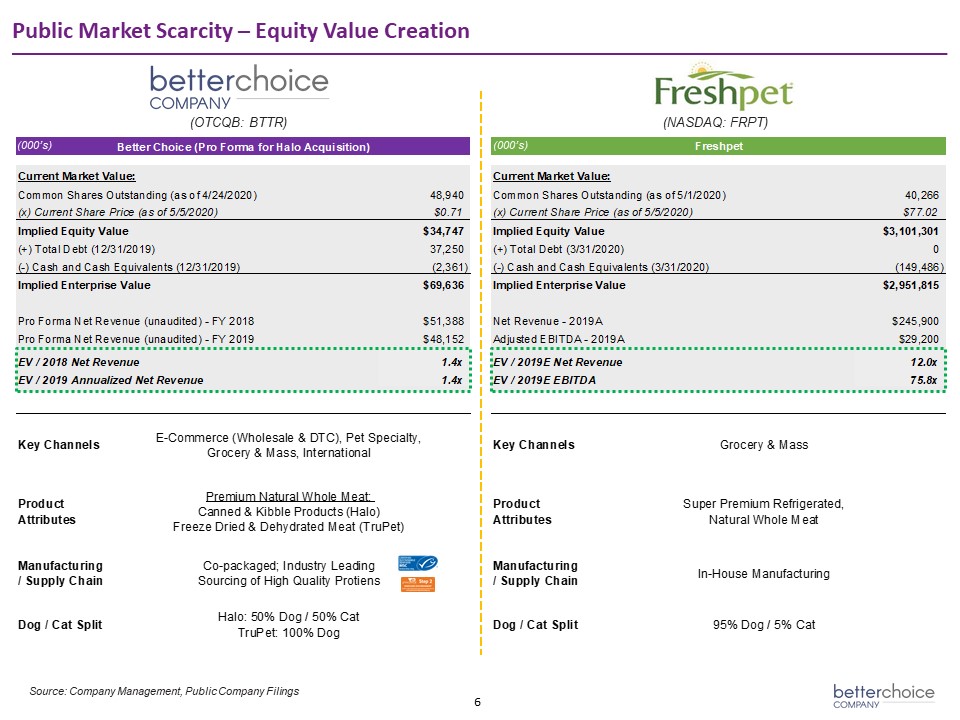

Public Market Scarcity – Equity Value Creation 6 Source: Company Management, Public Company

Filings (OTCQB: BTTR) (NASDAQ: FRPT) (000’s) (000’s)

Halo Overview 7

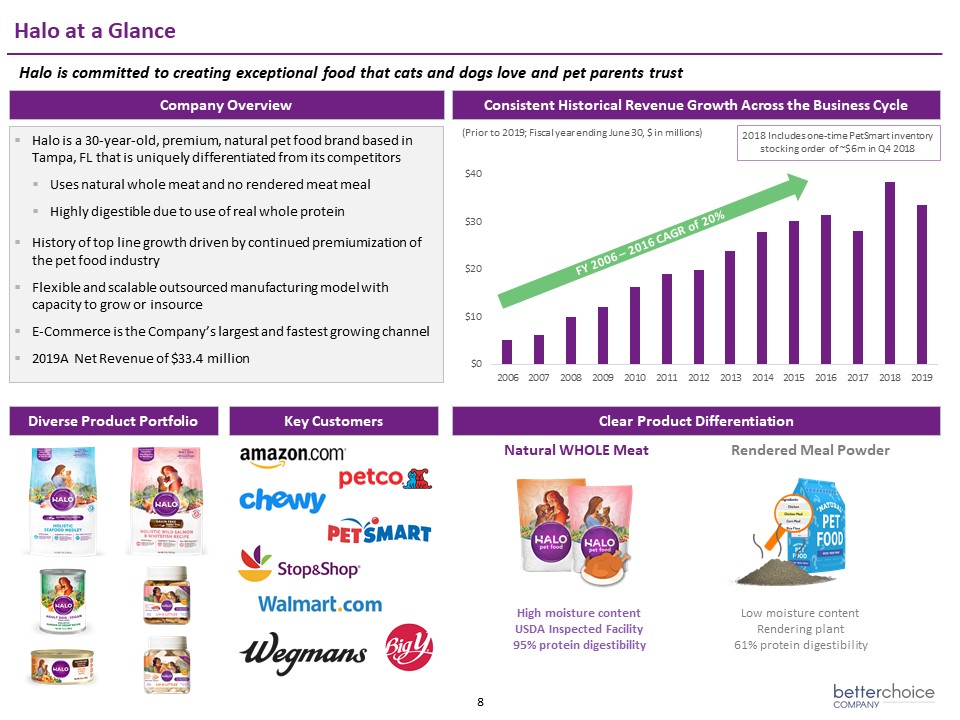

Halo is a 30-year-old, premium, natural pet food brand based in Tampa, FL that is uniquely

differentiated from its competitorsUses natural whole meat and no rendered meat mealHighly digestible due to use of real whole proteinHistory of top line growth driven by continued premiumization of the pet food industryFlexible and scalable

outsourced manufacturing model with capacity to grow or insourceE-Commerce is the Company’s largest and fastest growing channel2019A Net Revenue of $33.4 million Company Overview Halo is committed to creating exceptional food that cats and

dogs love and pet parents trust 8 Consistent Historical Revenue Growth Across the Business Cycle Diverse Product Portfolio Natural WHOLE Meat Rendered Meal Powder High moisture contentUSDA Inspected Facility95% protein

digestibility Low moisture contentRendering plant61% protein digestibility Clear Product Differentiation (Prior to 2019; Fiscal year ending June 30, $ in millions) Halo at a Glance FY 2006 – 2016 CAGR of 20% Key Customers 2018 Includes

one-time PetSmart inventory stocking order of ~$6m in Q4 2018

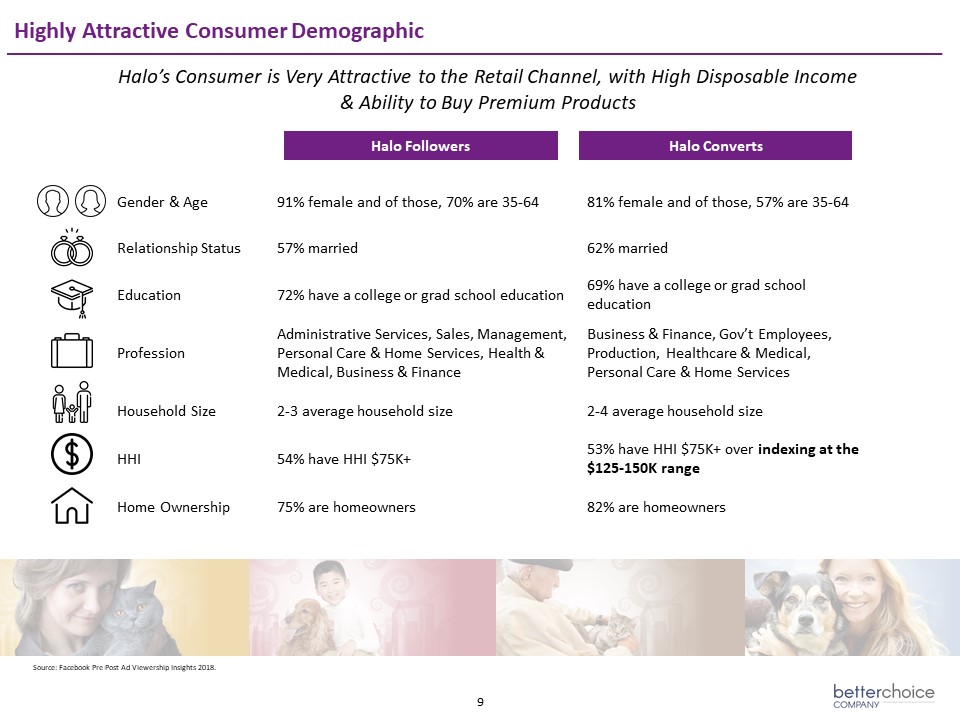

Highly Attractive Consumer Demographic 9 Gender & Age 91% female and of those, 70% are

35-64 81% female and of those, 57% are 35-64 Relationship Status 57% married 62% married Education 72% have a college or grad school education 69% have a college or grad school education Profession Administrative Services, Sales,

Management, Personal Care & Home Services, Health & Medical, Business & Finance Business & Finance, Gov’t Employees, Production, Healthcare & Medical, Personal Care & Home Services Household Size 2-3 average

household size 2-4 average household size HHI 54% have HHI $75K+ 53% have HHI $75K+ over indexing at the $125-150K range Home Ownership 75% are homeowners 82% are homeowners Halo Followers Halo Converts Halo’s Consumer is Very

Attractive to the Retail Channel, with High Disposable Income & Ability to Buy Premium Products Source: Facebook Pre-Post Ad Viewership Insights 2018.

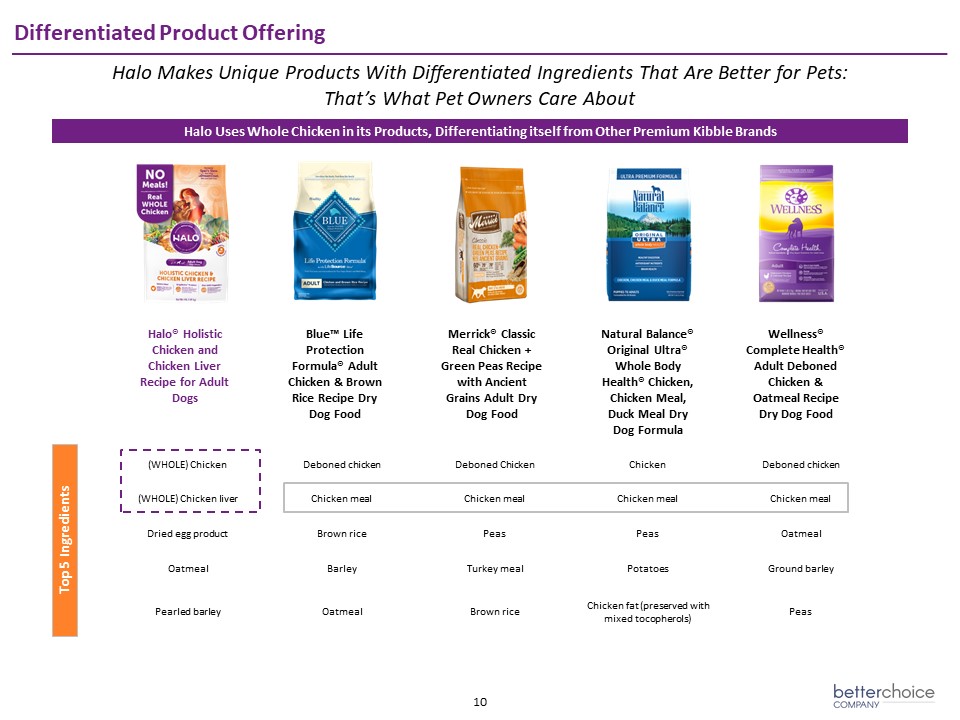

Differentiated Product Offering 10 Halo Uses Whole Chicken in its Products, Differentiating itself

from Other Premium Kibble Brands Halo® Holistic Chicken and Chicken Liver Recipe for Adult Dogs Blue™ Life Protection Formula® Adult Chicken & Brown Rice Recipe Dry Dog Food Merrick® Classic Real Chicken + Green Peas Recipe with

Ancient Grains Adult Dry Dog Food Natural Balance® Original Ultra® Whole Body Health® Chicken, Chicken Meal, Duck Meal Dry Dog Formula Wellness® Complete Health® Adult Deboned Chicken & Oatmeal Recipe Dry Dog Food (WHOLE)

Chicken Deboned chicken Deboned Chicken Chicken Deboned chicken (WHOLE) Chicken liver Chicken meal Chicken meal Chicken meal Chicken meal Dried egg product Brown rice Peas Peas Oatmeal Oatmeal Barley Turkey meal

Potatoes Ground barley Pearled barley Oatmeal Brown rice Chicken fat (preserved with mixed tocopherols) Peas Top 5 Ingredients Halo Makes Unique Products With Differentiated Ingredients That Are Better for Pets: That’s What Pet

Owners Care About

Broad Set of Suppliers Specialized by Product Strong Co-Packer Relationships &

Certifications 11 Primary co-packer for Kibbles Primary co-packer for Canned Food Smaller co-packers for Supplements & Treats High Quality Ingredient Certifications

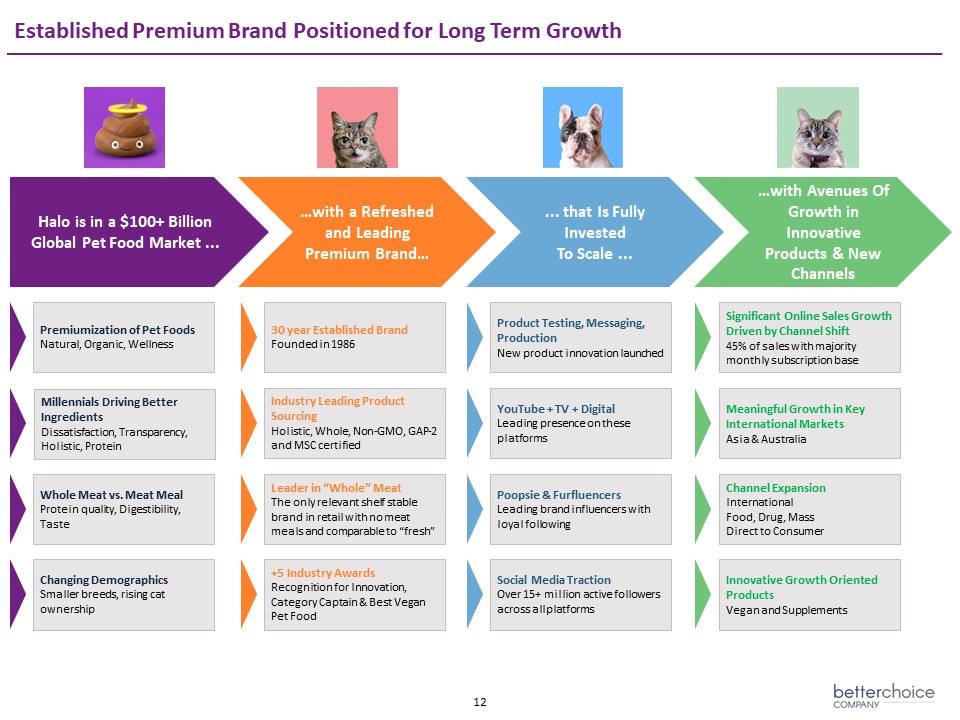

Halo is in a $100+ Billion Global Pet Food Market ... …with a Refreshed and Leading Premium Brand…

... that Is Fully InvestedTo Scale ... …with Avenues Of Growth in Innovative Products & New Channels Premiumization of Pet FoodsNatural, Organic, Wellness Whole Meat vs. Meat MealProtein quality, Digestibility, Taste Changing

DemographicsSmaller breeds, rising cat ownership 30 year Established BrandFounded in 1986 Industry Leading Product SourcingHolistic, Whole, Non-GMO, GAP-2 and MSC certified Leader in “Whole” MeatThe only relevant shelf stable brand in

retail with no meat meals and comparable to “fresh” +5 Industry AwardsRecognition for Innovation, Category Captain & Best Vegan Pet Food Product Testing, Messaging, ProductionNew product innovation launched YouTube + TV +

DigitalLeading presence on these platforms Poopsie & FurfluencersLeading brand influencers with loyal following Social Media TractionOver 15+ million active followers across all platforms Significant Online Sales Growth Driven by

Channel Shift45% of sales with majoritymonthly subscription base Meaningful Growth in Key International MarketsAsia & Australia Channel ExpansionInternationalFood, Drug, MassDirect to Consumer Innovative Growth Oriented ProductsVegan

and Supplements Millennials Driving Better IngredientsDissatisfaction, Transparency, Holistic, Protein Established Premium Brand Positioned for Long Term Growth 12

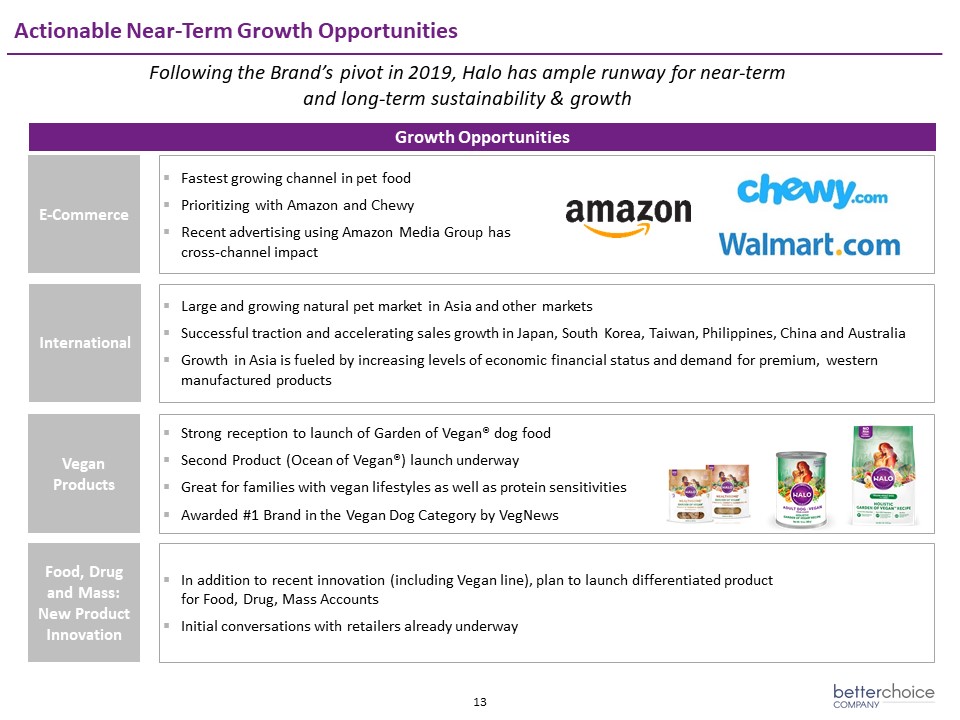

Growth Opportunities Actionable Near-Term Growth Opportunities Following the Brand’s pivot in 2019,

Halo has ample runway for near-term and long-term sustainability & growth 13 E-Commerce Vegan Products Food, Drug and Mass: New Product Innovation Fastest growing channel in pet foodPrioritizing with Amazon and ChewyRecent

advertising using Amazon Media Group has cross-channel impact Strong reception to launch of Garden of Vegan® dog food Second Product (Ocean of Vegan®) launch underway Great for families with vegan lifestyles as well as protein

sensitivitiesAwarded #1 Brand in the Vegan Dog Category by VegNews In addition to recent innovation (including Vegan line), plan to launch differentiated product for Food, Drug, Mass AccountsInitial conversations with retailers already

underway International Large and growing natural pet market in Asia and other marketsSuccessful traction and accelerating sales growth in Japan, South Korea, Taiwan, Philippines, China and AustraliaGrowth in Asia is fueled by increasing

levels of economic financial status and demand for premium, western manufactured products

TruPet Overview 14

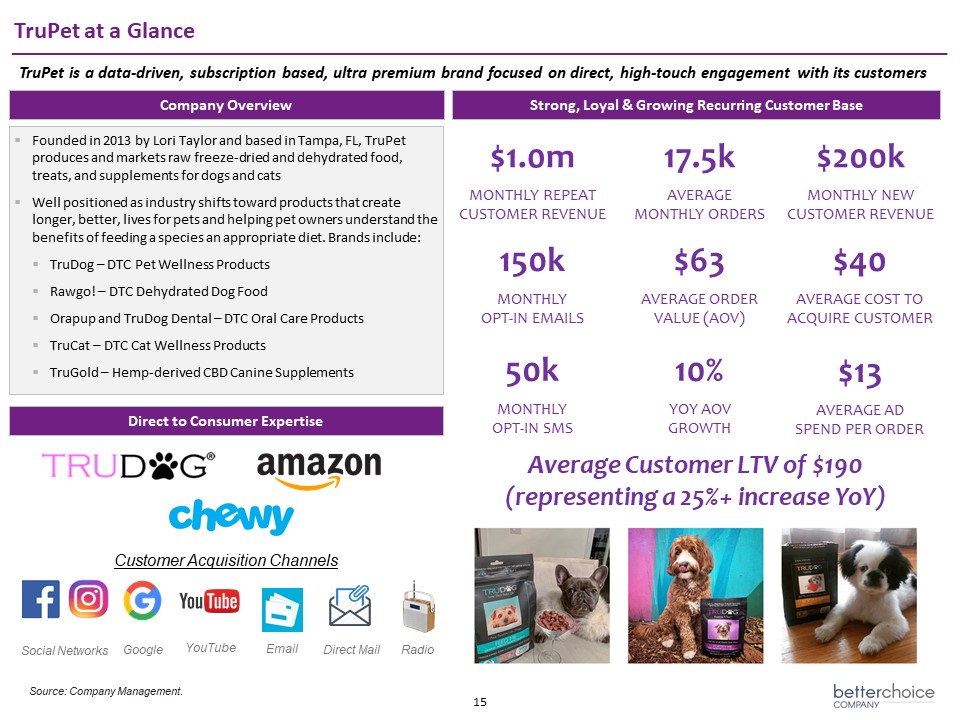

Founded in 2013 by Lori Taylor and based in Tampa, FL, TruPet produces and markets raw freeze-dried and

dehydrated food, treats, and supplements for dogs and cats Well positioned as industry shifts toward products that create longer, better, lives for pets and helping pet owners understand the benefits of feeding a species an appropriate diet.

Brands include:TruDog – DTC Pet Wellness ProductsRawgo! – DTC Dehydrated Dog FoodOrapup and TruDog Dental – DTC Oral Care ProductsTruCat – DTC Cat Wellness ProductsTruGold – Hemp-derived CBD Canine Supplements Company Overview TruPet is a

data-driven, subscription based, ultra premium brand focused on direct, high-touch engagement with its customers 15 Strong, Loyal & Growing Recurring Customer Base Direct to Consumer Expertise TruPet at a Glance Social

Networks Google Email Direct Mail Radio YouTube Customer Acquisition Channels $1.0mMONTHLY REPEAT CUSTOMER REVENUE 150kMONTHLY OPT-IN EMAILS 50kMONTHLY OPT-IN SMS 17.5kAVERAGE MONTHLY ORDERS 10%YOY AOV GROWTH $63AVERAGE ORDER

VALUE (AOV) $200kMONTHLY NEW CUSTOMER REVENUE $40AVERAGE COST TO ACQUIRE CUSTOMER $13AVERAGE AD SPEND PER ORDER Source: Company Management. Average Customer LTV of $190 (representing a 25%+ increase YoY)

Financials 16

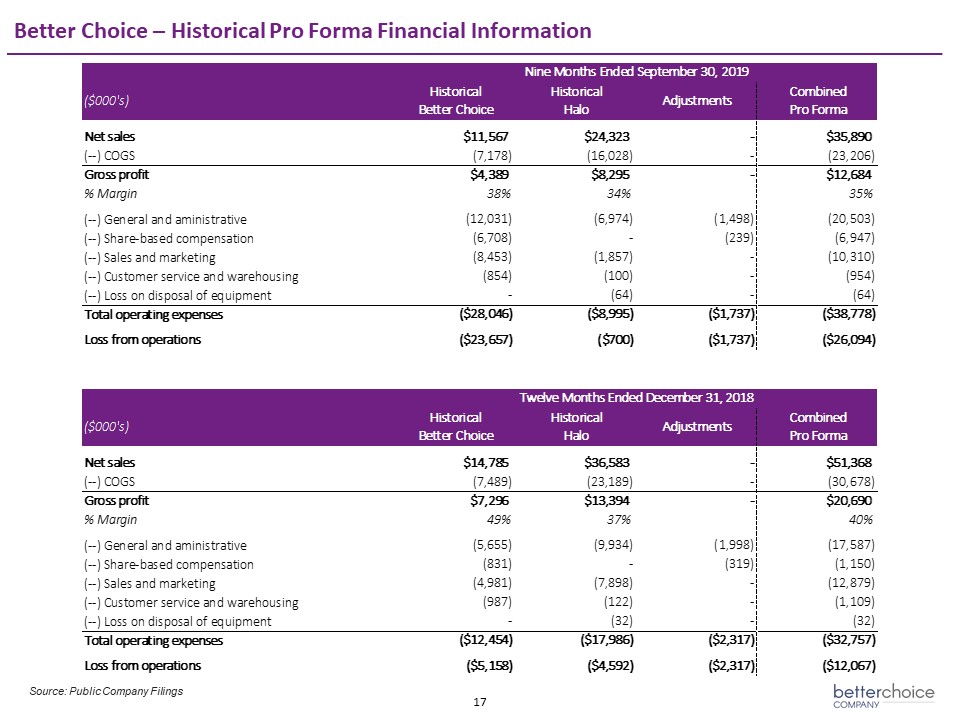

Better Choice – Historical Pro Forma Financial Information 17 Source: Public Company Filings

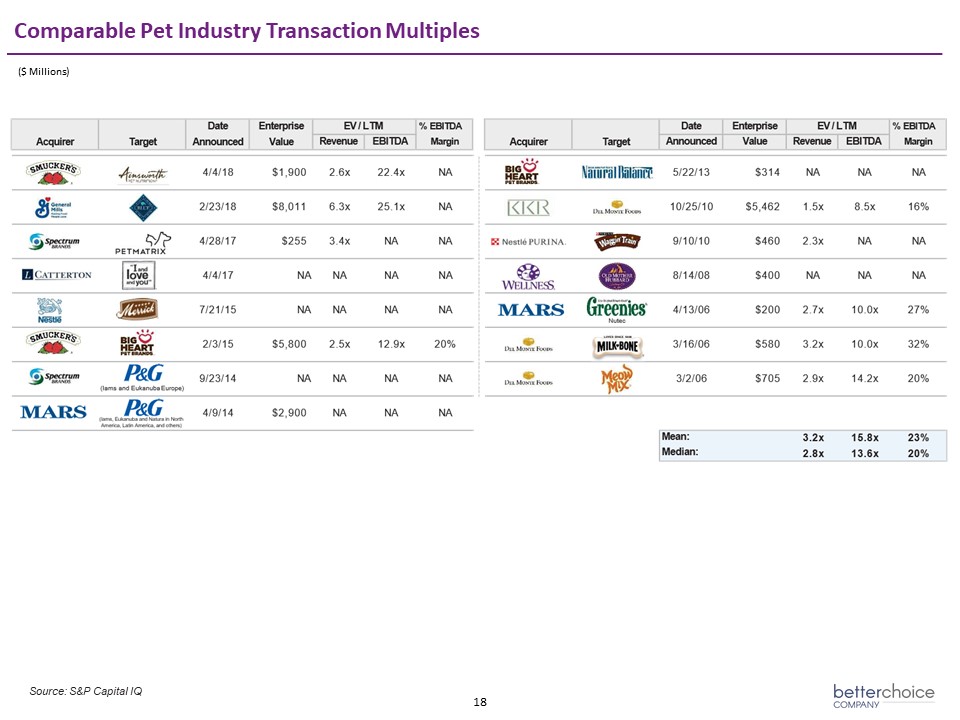

Comparable Pet Industry Transaction Multiples 18 ($ Millions) Source: S&P Capital IQ

Appendix – BTTR Team 19

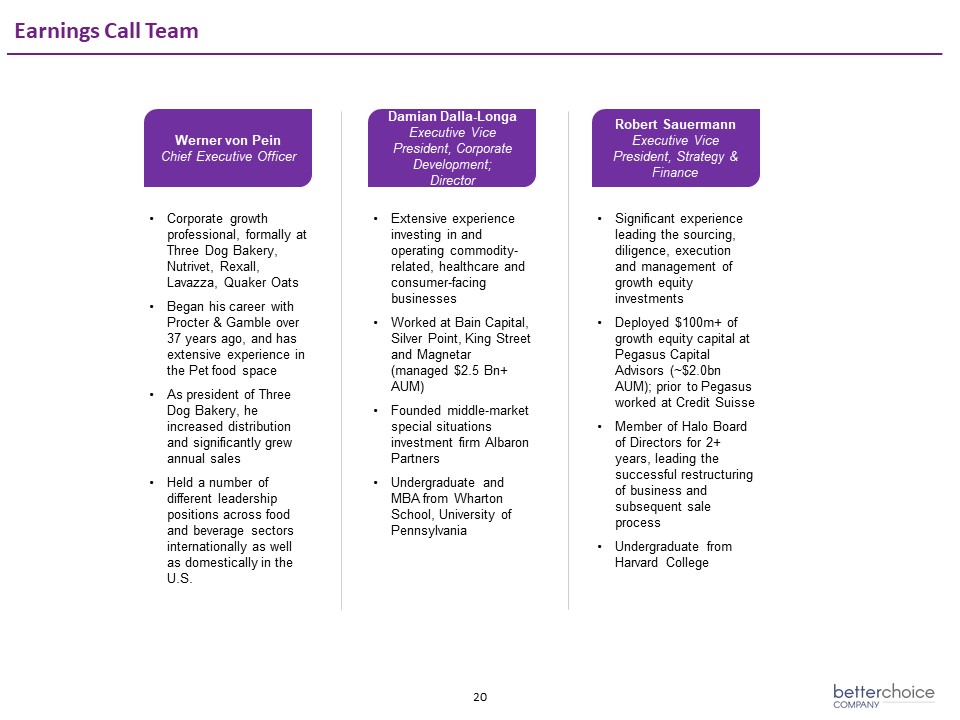

Earnings Call Team Werner von PeinChief Executive Officer Corporate growth professional, formally at

Three Dog Bakery, Nutrivet, Rexall, Lavazza, Quaker OatsBegan his career with Procter & Gamble over 37 years ago, and has extensive experience in the Pet food spaceAs president of Three Dog Bakery, he increased distribution and

significantly grew annual salesHeld a number of different leadership positions across food and beverage sectors internationally as well as domestically in the U.S. Extensive experience investing in and operating commodity-related, healthcare

and consumer-facing businessesWorked at Bain Capital, Silver Point, King Street and Magnetar (managed $2.5 Bn+ AUM)Founded middle-market special situations investment firm Albaron PartnersUndergraduate and MBA from Wharton School, University

of Pennsylvania Damian Dalla-LongaExecutive Vice President, Corporate Development;Director Significant experience leading the sourcing, diligence, execution and management of growth equity investmentsDeployed $100m+ of growth equity capital

at Pegasus Capital Advisors (~$2.0bn AUM); prior to Pegasus worked at Credit SuisseMember of Halo Board of Directors for 2+ years, leading the successful restructuring of business and subsequent sale processUndergraduate from Harvard

College Robert SauermannExecutive Vice President, Strategy & Finance 20

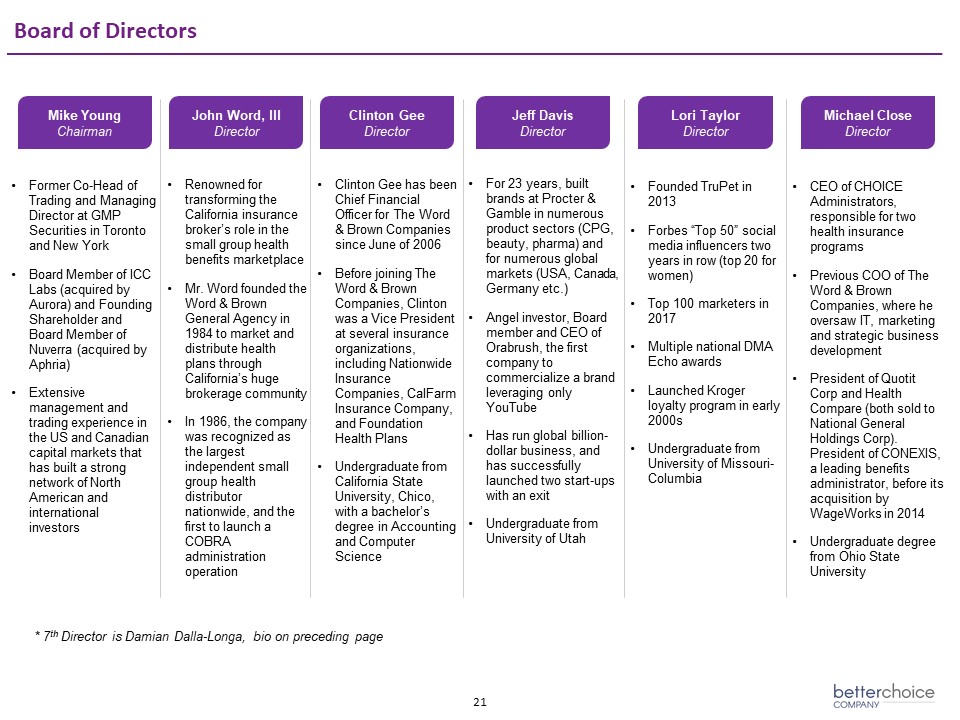

21 Former Co-Head of Trading and Managing Director at GMP Securities in Toronto and New YorkBoard

Member of ICC Labs (acquired by Aurora) and Founding Shareholder and Board Member of Nuverra (acquired by Aphria)Extensive management and trading experience in the US and Canadian capital markets that has built a strong network of North

American and international investors Mike YoungChairman Renowned for transforming the California insurance broker’s role in the small group health benefits marketplace Mr. Word founded the Word & Brown General Agency in 1984 to market

and distribute health plans through California’s huge brokerage community In 1986, the company was recognized as the largest independent small group health distributor nationwide, and the first to launch a COBRA administration operation John

Word, IIIDirector For 23 years, built brands at Procter & Gamble in numerous product sectors (CPG, beauty, pharma) and for numerous global markets (USA, Canada, Germany etc.)Angel investor, Board member and CEO of Orabrush, the first

company to commercialize a brand leveraging only YouTubeHas run global billion-dollar business, and has successfully launched two start-ups with an exitUndergraduate from University of Utah Jeff DavisDirector Founded TruPet in 2013Forbes

“Top 50” social media influencers two years in row (top 20 for women)Top 100 marketers in 2017 Multiple national DMA Echo awardsLaunched Kroger loyalty program in early 2000s Undergraduate from University of Missouri-Columbia Lori

TaylorDirector CEO of CHOICE Administrators, responsible for two health insurance programsPrevious COO of The Word & Brown Companies, where he oversaw IT, marketing and strategic business developmentPresident of Quotit Corp and Health

Compare (both sold to National General Holdings Corp). President of CONEXIS, a leading benefits administrator, before its acquisition by WageWorks in 2014Undergraduate degree from Ohio State University Michael CloseDirector Clinton Gee has

been Chief Financial Officer for The Word & Brown Companies since June of 2006Before joining The Word & Brown Companies, Clinton was a Vice President at several insurance organizations, including Nationwide Insurance Companies,

CalFarm Insurance Company, and Foundation Health PlansUndergraduate from California State University, Chico, with a bachelor’s degree in Accounting and Computer Science Clinton GeeDirector * 7th Director is Damian Dalla-Longa, bio on

preceding page Board of Directors