Increasing Liquidity and Institutional Participation in the Cryptocurrency Markets April 2018(Symbol: SENZ)

Safe Harbor Statement This presentation includes statements that are, or may be deemed, ‘‘forward-looking statements.’’ In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately,” potential” or other variations thereon or comparable terminology, although not all forward-looking statements contain these words.By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, regulatory and economic developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this presentation, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward looking statements contained in this presentation, as a result of, among other factors, the factors referenced in the “Risk Factors” section of our Form 8-K filed with the Securities and Exchange Commission on March 14,2018.In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this presentation, they may not be predictive of results or developments in future periods. Any forward-looking statements that we make in this presentation speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this presentation. You should read carefully the factors described in the “Risk Factors” section of our Form 8-K. 2

Provide institutional investors the ability to borrow, hedge, and arbitrage cryptocurrencies that trade on the various cryptocurrency exchanges including Bitcoin, Bitcoin cash, Ethereum and Litecoin.

Company Overview Facilitates the ability of institutional investors to participate in the fixed income opportunity of cryptocurrency investing. Through the lending program of our partner, institutional investors can better manage cryptocurrency risk and increase yield to maximize return on investment for their funds. The lending program is a diversified investment vehicle for institutional investors who are looking for managed exposure to the cryptocurrency market. SENZ is leveraging its expertise in marketing and customer acquisition to build its portfolio of institutional clients. 4

Industry Overview If something trades at difference prices in multiple places, buy it where it is cheap and sell it where it is expensive. Bitcoin, for example trades on more than 100 exchanges around the globe and hundred of other currencies trade in venues few people have heard of. According to a February 4, 2018, article in the Wall Street Journal, Bitcoin’s price can vary across different exchanges, at times, such spreads have widened into the thousands of dollars.Price of bitcoin can diverge between exchanges due to glitches or network traffic jams that slow transfers between users. According to a February 4, 2018, article in the Wall Street Journal, at times price differences have widened to 1-% or more, or thousands of dollars, and in some cases persisted for days. 5 Cryptocurrency Trading Inefficiencies - Arbitrage Issue is obvious, but only institutional investors are POTENTIALLY able to benefit Because:Difficult to sell asset on one exchange, enter the blockchain, deposit onto another exchange, and generate a return in a timely mannerIndividuals do not have the trading expertise to effectuateIndividuals do not have the size of inventory that makes it worthwhile to effectuate Reference: Wall Street Journal, “Bitcoins Crashing, that Won’t Stop Arbitrage Traders from Raking in Millions” https://www.wsj.com/articles/bitcoins-crashing-that-wont-stop-arbitrage-traders-from-raking-in-millions-1517749201

Industry Overview If something trades at difference prices in multiple places, buy it where it is cheap and sell it where it is expensive. Bitcoin, for example trades on more than 100 exchanges around the globe and hundred of other currencies trade in venues few people have heard of. Bitcoin’s price can vary across different exchanges, at times, such spreads have widened into the thousands of dollars.Price of bitcoin can diverge between exchanges due to glitches or network traffic jams that slow transfers between users. At times, price differences have widened to 1-% or more, or thousands of dollars, and in some cases persisted for days. 5 Cryptocurrency Trading Inefficiencies - Arbitrage Issue is obvious, but only institutional investors are POTENTIALLY able to benefit Because:Difficult to sell asset on one exchange, enter the blockchain, deposit onto another exchange, and generate a return in a timely mannerIndividuals do not have the trading expertise to effectuateIndividuals do not have the size of inventory that makes it worthwhile to effectuate Reference: Wall Street Journal, “Bitcoins Crashing, that Won’t Stop Arbitrage Traders from Raking in Millions” https://www.wsj.com/articles/bitcoins-crashing-that-wont-stop-arbitrage-traders-from-raking-in-millions-1517749201

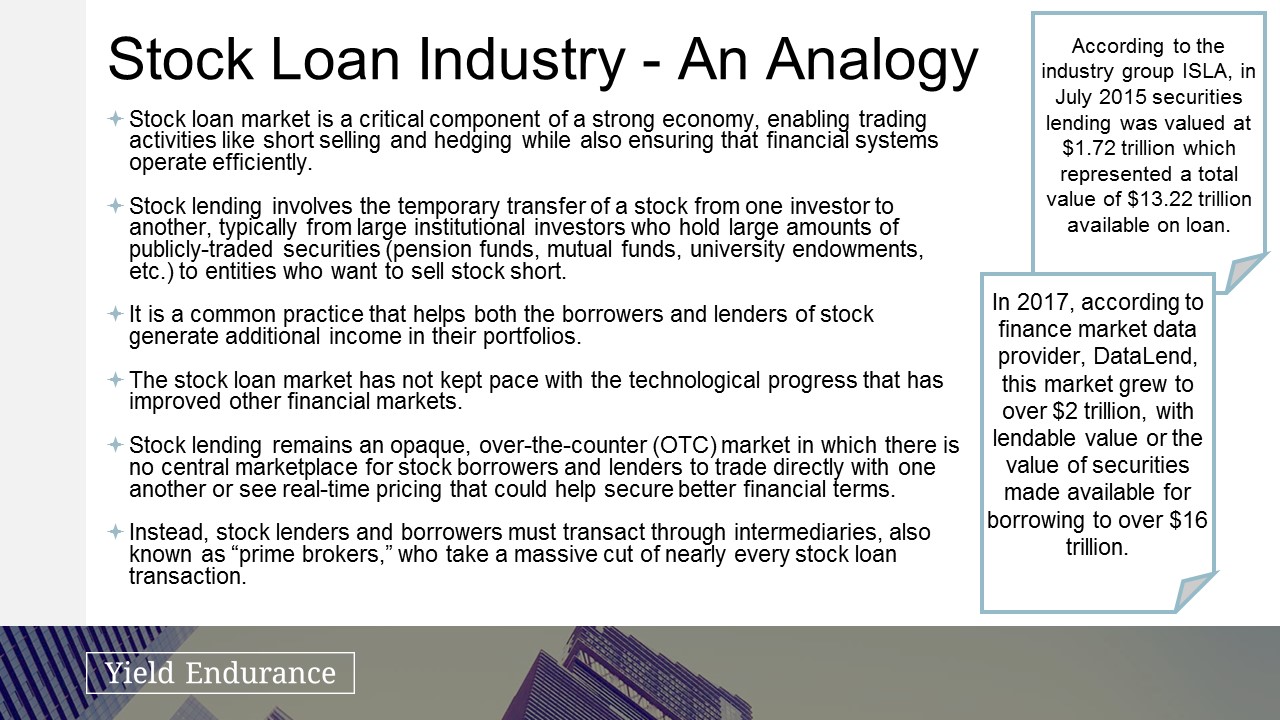

Stock Loan Industry - An Analogy Stock loan market is a critical component of a strong economy, enabling trading activities like short selling and hedging while also ensuring that financial systems operate efficiently. Stock lending involves the temporary transfer of a stock from one investor to another, typically from large institutional investors who hold large amounts of publicly-traded securities (pension funds, mutual funds, university endowments, etc.) to entities who want to sell stock short. It is a common practice that helps both the borrowers and lenders of stock generate additional income in their portfolios.The stock loan market has not kept pace with the technological progress that has improved other financial markets. Stock lending remains an opaque, over-the-counter (OTC) market in which there is no central marketplace for stock borrowers and lenders to trade directly with one another or see real-time pricing that could help secure better financial terms. Instead, stock lenders and borrowers must transact through intermediaries, also known as “prime brokers,” who take a massive cut of nearly every stock loan transaction. According to the industry group ISLA, in July 2015 securities lending was valued at $1.72 trillion which represented a total value of $13.22 trillion available on loan. In 2017, according to finance market data provider, DataLend, this market grew to over $2 trillion, with lendable value or the value of securities made available for borrowing to over $16 trillion.

What Problem Are We Solving? Cryptocurrency borrowing is still an emerging feature resulting in…Greater market volatilityInefficiency and instability of marketInability for investors to maintain a stable return on investmentYield Endurance helps address this inefficiency by…Alleviating the investor’s lack of technology and trading expertiseIncreasing institutional participation in cryptocurrency markets by enabling investors to short and hedge positions Giving “hodlers” a way to earn yield on their crypto assets 7

Main Drivers for this Initiative in Cryptocurrency 8 Crypto owners need a tax-friendly yield strategy Crypto owners and investors can now hedge their risk Crypto traders can borrow for arbitrage trading

Business Model Facilitate institutional investors in participating in the fixed income or yield potential of cryptocurrency investing.Fund loans SENZ cryptocurrency (bitcoin, bitcoin cash, ethereum or litecoin) in exchange for interest paymentsSENZ, through its partner Madison Partners, lends end client cryptocurrency at varying terms per dealEnd client uses the borrow to short, hedge, and arbitrage the cryptocurrencyMadison pays SENZ a profit shareRevenue share after expenses on monthly basisSENZ pays fund periodic interest payments on cryptocurrency loan 9

Strategic Partners Madison Partners, a registered MSB, is a market-leading liquidity provider for trade execution in digital assets and cryptocurrency worldwide. Their technology and infrastructure provides excellent access to the electronic markets and a myriad of tools to ease cost of routing and market impact.Transaction stage: RenGen (first institutional investor client): $5M bitcoin loan to SENZSENZ (public vehicle, transaction intermediary, operational facilitator)Grants access of inventory to Madison Partners to lend out to the marketMadison Partners (trading arm)Lends crypto to market participants generating fees to be split with SENZ 10

11 Institutional investors who lack crypto shorting, hedging, or arbitrage capabilitiesInstitutional investors who have $5M+ in eligible crypto assetsInstitutional investors who are looking for yield on their crypto assets Target Clients

Growth Strategy There is significant growth potential in the SENZ model. The more assets the Company is able to lend, the more revenue and higher margin the Company expects to be able to generate. The growth strategy of the Company is to build their portfolio of institutional lending sources and increase their inventory of loanable cryptocurrency assets. 12

Competition 13

Investment Highlights For ‘non-institutional investors’, investing in cryptocurrency is highly riskyThis investor pool does not have the technology, trading expertise, nor inventory to hedge, short and arbitrage as a institutional investor doesSimilar to a mutual fund or ETF, SENZ is a smarter, more diversified investment strategy for those who want exposure to cryptocurrency markets with less volatility Indirect exposure to institutional caliber cryptocurrency trading operationImmediate exposure to cryptocurrency, rather than waiting for Company to develop/explore opportunities 14

For more information, please contact Investor Contact:Valter Pinto, Managing DirectorKCSA Strategic CommunicationsPH: (212) 896-1254valter@KCSA.com