Execution Version Notwithstanding anything herein to the contrary, the Liens and security interests granted to Alphia Inc., as Lender, pursuant to this Agreement in any Collateral and the exercise of any right or remedy by Alphia Inc., with respect to any Collateral hereunder are subject to the provisions of the Intercreditor Agreement, dated as of June 21, 2023 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof, the “Intercreditor Agreement”), between Wintrust Bank N.A. and Alphia Inc.. In the event of any conflict between the terms of the Intercreditor Agreement and the terms of this Agreement, the terms of the Intercreditor Agreement shall govern and control. TERM LOAN SECURITY AGREEMENT Dated June 21, 2023 among The Grantors referred to herein, as Grantors and ALPHIA INC., as Lender

TABLE OF CONTENTS Section Page i Section 1. Defined Terms .................................................................................................................... 1 Section 2. Grant of Security ................................................................................................................. 2 Section 3. Security for Obligations ...................................................................................................... 7 Section 4. Grantors Remain Liable ...................................................................................................... 7 Section 5. Delivery and Control of Security Collateral ....................................................................... 7 Section 6. Electronic Chattel Paper, Transferable Records; Giving Notice of Commercial Tort Claims; Letter of Credit Rights ........................................................................................... 9 Section 7. Representations and Warranties .......................................................................................... 9 Section 8. Further Assurances ........................................................................................................... 11 Section 9. Post-Closing Changes; Bailees; Collections on Assigned Agreements and Accounts ..... 11 Section 10. As to Intellectual Property Collateral ............................................................................... 12 Section 11. Voting Rights; Dividends; Etc. ......................................................................................... 14 Section 12. Lender Appointed Attorney-in-Fact ................................................................................. 15 Section 13. Lender May Perform ......................................................................................................... 15 Section 14. Lender’s Duties ................................................................................................................. 15 Section 15. Remedies ........................................................................................................................... 15 Section 16. Amendments; Waivers; Additional Grantors; Etc. ........................................................... 17 Section 17. Notices, Etc. ...................................................................................................................... 18 Section 18. Continuing Security Interest; Assignments under the Term Loan Credit Agreement ...... 18 Section 19. Release; Termination ........................................................................................................ 18 Section 20. Execution in Counterparts................................................................................................. 19 Section 21. The Mortgages .................................................................................................................. 19 Section 22. Governing Law; Jurisdiction; Etc. .................................................................................... 19 Section 23. Intercreditor Agreement .................................................................................................... 20

ii Schedules Schedule I - Location, Chief Executive Office, Place Where Agreements Are Maintained, Type Of Organization, Jurisdiction Of Organization And Organizational Identification Number Schedule II - Pledged Interests Schedule III - Patents, Trademarks and Copyrights Schedule IV - Commercial Tort Claims Exhibits: Exhibit A - Form of Term Loan Security Agreement Supplement Exhibit B - Form of Term Loan Intellectual Property Security Agreement Exhibit C - Form of Term Loan Intellectual Property Security Agreement Supplement

1 TERM LOAN SECURITY AGREEMENT, dated June 21, 2023 (this “Agreement”), among each of the signatories hereto designated as a Grantor on the signature pages hereto (together with any other entity that may become a party hereto as a Grantor, as provided herein, each a “Grantor” and collectively, the “Grantors”), and ALPHIA INC., as Lender (the “Lender”). PRELIMINARY STATEMENTS WHEREAS, Better Choice Company Inc., a Delaware corporation (the “Borrower”) and Alphia Inc., as Lender have entered into a Term Loan Credit Agreement dated of even date herewith (as amended, amended and restated, supplemented, replaced, refinanced or otherwise modified from time to time (including any increases of the principal amount outstanding thereunder), the “Term Loan Credit Agreement”); WHEREAS, pursuant to the Term Loan Credit Agreement, the Grantors are entering into this Agreement in order to grant to the Lender, a security interest in the Collateral (as hereinafter defined); and WHEREAS, each Grantor will derive substantial direct and indirect benefit from the transactions contemplated by the Loan Documents. NOW, THEREFORE, in consideration of the premises and in order to induce the Lender to make the Term Loan, each Grantor hereby agrees with the Lender as follows: Section 1. Defined Terms. “UCC” shall mean the Uniform Commercial Code as in effect from time to time in the State of New York; provided that, if by reason of any mandatory provisions of law, the perfection, the effect of perfection or non-perfection or priority of the security interests granted to the Lender pursuant to this Agreement are governed by the Uniform Commercial Code as in effect in a jurisdiction of the United States other than New York, then “UCC” means the Uniform Commercial Code as in effect from time to time in such other jurisdiction for purposes of such perfection, effect of perfection or non-perfection or priority. Terms defined in the Term Loan Credit Agreement and not otherwise defined in this Agreement are used in this Agreement as defined in the Term Loan Credit Agreement; provided that terms defined in Article 8 or 9 of the UCC are used in this Agreement as such terms are defined in such Article 8 or 9 (including Accounts, Certificated Security, Chattel Paper, Commercial Tort Claims, Commodity Account, Commodity Contract, Deposit Accounts, Documents, Equipment, Financial Assets, Fixtures, General Intangibles, Goods, Instruments, Inventory, Investment Property, Letter of Credit Rights, Securities Accounts, Securities Intermediary, Security, Security Entitlements and Supporting Obligations). “Collateral Access Agreement” means any landlord waiver, property access or other agreement, in form and substance reasonably satisfactory to the Lender, between the Lender and any third party (including any landlord, bailee, consignee, customs broker, inventory or other property manager or other similar Person) in possession of any Collateral or any landlord of any real property where any Collateral is located, as such landlord waiver, property access or other agreement may be amended, restated, supplemented or otherwise modified from time to time. Section 2. Grant of Security. As security for the payment or performance, as the case may be, in full of the Secured Obligations (as defined below), each Grantor hereby grants to the Lender, a security interest in such Grantor’s right, title and interest in and to the following, in each case, as to each type of property described below, whether now owned or hereafter acquired by such Grantor, wherever located, and whether now or hereafter existing or arising (collectively, the “Collateral”): (a) all Accounts;

2 (b) all cash and Cash Equivalents; (c) all Chattel Paper; (d) all Commercial Tort Claims set forth on Schedule IV hereto or for which notice is provided or is required to be provided pursuant to Section 6(b) below; (e) all Deposit Accounts; (f) all Documents; (g) all Equipment; (h) all Fixtures; (i) all General Intangibles; (j) all Goods; (k) all Instruments; (l) all Inventory; (m) all Letter of Credit Rights; (n) the following (the “Security Collateral”): (i) all indebtedness from time to time owed to such Grantor, including, without limitation, the Indebtedness set forth opposite such Grantor’s name on and otherwise described on Schedule II (as such Schedule II may be supplemented from time to time by supplements to this Agreement) (all such indebtedness whether or not so set forth being the “Pledged Debt”), and the instruments and promissory notes, if any, evidencing such indebtedness, and all interest, cash, instruments and other property from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of the Pledged Debt; and (ii) all Equity Interests of any Person from time to time acquired, owned or held directly by such Grantor in any manner, including, without limitation, the Equity Interests owned or held by each Grantor set forth opposite such Grantor’s name on and otherwise described on Schedule II (as such Schedule II may be supplemented from time to time by supplements to this Agreement) (all such Equity Interests whether or not so set forth being the “Pledged Interests”), and the certificates, if any, representing such shares or units or other Equity Interests, and all dividends, distributions, return of capital, cash, instruments and other property from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such shares or other Equity Interests and all warrants, rights or options issued thereon or with respect thereto; (o) all Investment Property and all Financial Assets, and all dividends, distributions, return of capital, interest, cash, instruments and other property from time to time received, receivable or otherwise distributed in respect of or in exchange therefor and all warrants, rights or options issued thereon or with respect thereto;

3 (p) all contracts and agreements between any Grantor and one or more additional parties (including, without limitation, any Swap Contracts, licensing agreements and any partnership agreements, joint venture agreements, limited liability company agreements) and the IP Agreements (as hereinafter defined), in each case as such agreements may be amended, amended and restated, supplemented or otherwise modified from time to time (collectively, the “Assigned Agreements”), including, without limitation, all rights of such Grantor to receive moneys due and to become due under or pursuant to the Assigned Agreements (all such Collateral in this clause (p) being the “Agreement Collateral”); (q) the following (collectively, the “Intellectual Property Collateral”) with respect to any Grantor to the extent governed by, arising under, pursuant to, or by virtue of, the laws of the United States of America or any state thereof: (i) all patents, patent applications, utility models, statutory invention registrations and all inventions, including those claimed or disclosed therein and all improvements thereto (“Patents”); (ii) all trademarks, trademark applications, service marks, domain names, trade dress, logos, designs, slogans, trade names, business names, corporate names and other source identifiers, and all general intangibles of like nature whether registered or unregistered, together, in each case, with the goodwill symbolized thereby (“Trademarks”); (iii) all copyrights, including, without limitation, copyrights in Computer Software (as hereinafter defined), internet web sites and the content thereof, whether registered or unregistered (“Copyrights”); (iv) all computer software, programs and databases (including, without limitation, source code, object code and all related applications and data files), firmware and documentation and materials relating thereto, together with any and all maintenance rights, service rights, programming rights, hosting rights, test rights, improvement rights, renewal rights and indemnification rights and any substitutions, replacements, improvements, error corrections, updates and new versions of any of the foregoing (“Computer Software”); (v) all confidential and proprietary information, including, without limitation, know-how, trade secrets, manufacturing and production processes and techniques, inventions, research and development information, databases and data, including, without limitation, technical data, financial, marketing and business data, pricing and cost information, business and marketing plans and customer and supplier lists and information (collectively, “Trade Secrets”), and all other intellectual and intangible property of any type, including, without limitation, industrial designs and mask works; (vi) all registrations and applications for registration for any of the foregoing in the United States Patent and Trademark Office or the United States Copyright Office, as applicable, including, without limitation, the registrations and applications for registration of United States intellectual property set forth in Schedule III hereto (as such Schedule III may be supplemented from time to time by supplements to this Agreement, each such supplement being substantially in the form of Exhibit C hereto (an “IP Security Agreement Supplement”) executed by such Grantor in favor of the Lender from time to time), together with all reissues, divisions, continuations, continuations-in-part, extensions, renewals and reexaminations thereof (all such Intellectual Property Collateral that has been registered, or for the registration of which an

4 application has been made, in the United States Patent and Trademark Office or the United States Copyright Office, as applicable, the “Registered Intellectual Property Collateral”); (vii) all written agreements, permits, consents, orders and franchises relating to the license, development, use or disclosure of any of the foregoing to which such Grantor, now or hereafter, is a party or a beneficiary (“IP Agreements”) and all rights of such Grantor thereunder; and (viii) any and all claims for damages and injunctive relief for past, present and future infringement, dilution, misappropriation, violation, misuse or breach with respect to any of the foregoing, with the right, but not the obligation, to sue for and collect, or otherwise recover, such damages; (r) all books and records (including, without limitation, customer lists, credit files, printouts and other computer output materials and records) of such Grantor pertaining to any of the Collateral; (s) all other tangible and intangible personal property of whatever nature whether or not covered by Article 9 of the UCC; and (t) all proceeds of, collateral for, income, royalties and other payments now or hereafter due and payable with respect to, and Supporting Obligations relating to, any and all of the Collateral (including, without limitation, proceeds, collateral and Supporting Obligations that constitute property of the types described in clauses (a) through (q) of this Section 2), and, to the extent not otherwise included, all payments under insurance (whether or not the Lender is the loss payee thereof), or any indemnity, warranty or guaranty, payable by reason of loss or damage to or otherwise with respect to any of the foregoing Collateral; provided that notwithstanding anything to the contrary contained in the foregoing clauses (a) through (t), the security interest created by this Agreement shall not extend to, and the terms “Collateral,” “Security Collateral,” “Agreement Collateral,” “Intellectual Property Collateral” and other terms defining the components of the Collateral in the foregoing clauses (a) through (t) shall not include, any of the following (collectively, the “Excluded Assets”): (i) any lease, license or other agreement or any property subject to a purchase money security interest, a Capitalized Lease Obligation or other similar arrangement permitted under the Term Loan Credit Agreement to the extent that (and only for so long as) a grant of a security interest therein would violate or invalidate, or result in other adverse consequences to the Borrower and its Subsidiaries under, such lease, license, agreement, or purchase money, Capitalized Lease Obligation or similar arrangement, or create a right of termination in favor, or require the consent, of any other party thereto (other than any Borrower or any Guarantor), in each case to the extent (A) not rendered unenforceable pursuant to applicable provisions of the UCC or other applicable law and (B) such lease, license, agreement, or purchase money, Capitalized Lease Obligation or similar arrangement, right of termination or consent was not entered into in contemplation of the Transactions; provided, that the Collateral shall include proceeds and receivables (that are not otherwise Excluded Assets) of any property excluded under this clause (i) to the extent the assignment is expressly deemed effective under the UCC notwithstanding such prohibition; (ii) any assets acquired after the Closing Date, to the extent that, and for so long as, a grant of a security interest therein would violate an enforceable contractual obligation

5 assumed by any Grantor in connection with such acquisition that (A) is binding on such assets, (B) was existing at the time of the acquisition thereof and (C) was not created or made binding on such assets in contemplation or in connection with the acquisition of such assets, in each case to the extent the applicable prohibition or requirement for consent is not rendered ineffective pursuant to applicable provisions of the UCC; provided that the Collateral shall include proceeds and receivables (that are not otherwise Excluded Assets) of any property excluded under this clause (ii) to the extent the assignment is expressly deemed effective under the UCC notwithstanding such prohibition; (iii) [reserved]; (iv) [reserved]; (v) any property of any Grantor, to the extent (A) that any applicable Law or Governmental Authority prohibits the creation of a Lien thereon or such creation would require a consent of any Governmental Authority or any other Person (other than any Borrower or any of its Subsidiaries) that has not been obtained, in each case to the extent the applicable prohibition or requirement for consent is not rendered ineffective pursuant to applicable provisions of the UCC; provided that the Collateral shall include proceeds and receivables (that are not otherwise Excluded Assets) of any property excluded under this clause (A) to the extent the assignment is expressly deemed effective under the UCC notwithstanding such prohibition, or (B) such Grantor is prohibited from granting a lien on such property to secure the Term Facility by any Contractual Obligation in existence on the Closing Date (or, in the case of any newly acquired Subsidiary, in existence at the time of acquisition but not entered into in contemplation thereof); (vi) any intent-to-use trademark applications prior to the filing, and acceptance by the United States Patent and Trademark Office, of a “Statement of Use or “Amendment to Allege Use” with respect thereto, if any, to the extent that, and solely during the period in which, the grant of a security interest therein prior to such filing and acceptance would impair the validity or enforceability of such intent-to-use trademark applications or the resulting trademark applications under applicable federal law; (vii) any governmental licenses or state or local franchises, charters and authorizations, to the extent that (and only for so long as) a grant of a security interest therein would be prohibited or restricted thereby, in each case to the extent the applicable prohibition or restriction is not rendered ineffective after giving effect to the applicable provisions of the UCC; (viii) any margin stock (within the meaning of Regulation U issued by the FRB); and (ix) any personal property of any Grantor, to the extent that the Lender and the Borrower reasonably agree that the cost or burden of obtaining a security interest therein, would be excessive in relation to the practical benefit to the Lender obtained thereby. provided, further, however, that the term “Excluded Assets” shall not (x) include the shares of capital stock and limited liability company interests described in Schedule II and (y) include proceeds of any items contained in the foregoing clauses (i) through (ix) to the extent such Proceeds would not otherwise constitute an “Excluded Asset” pursuant to the terms of this Agreement. Notwithstanding anything to the contrary contained in the foregoing clauses (a) through (t) or in the Loan Documents, no Grantor shall be required to (w) enter into control agreements or other control arrangements

6 with respect to, or otherwise perfect any security interest by “control” including over, securities accounts, deposit accounts, other bank accounts, cash and cash equivalents and accounts related to the clearing, payment processing and similar operations of the Borrower and its Subsidiaries, or other assets specifically requiring perfection through control, other than certificates evidencing Pledged Interests in Subsidiaries (“Designated Pledged Interests”) and instruments evidencing Pledged Debt owed by any debtor having a fair market value (in the aggregate for all such Pledged Debt held by all Grantors owing by the applicable debtor) in excess of $50,000 (such Pledged Debt, the “Designated Pledged Debt”), (x) take any action in, or required by the laws of, any jurisdiction (other than in the United States of America, any state thereof and the District of Columbia) to create a security interest in or to perfect any security interest in any Collateral, including in Equity Interests of Foreign Subsidiaries or any intellectual property rights (it being understood that there shall be no security documents governed by the laws of any jurisdiction (other than in the United States of America, any state thereof and the District of Columbia) and there shall be no requirement of any Grantor to make any filings or take any action in any office in any foreign jurisdiction, including with respect to foreign intellectual property), (y) perfect the security interest in the following other than by the filing of a UCC financing statement in the filing office indicated in Section 9-501(a)(2) of the applicable UCC: (1) Letter of Credit Rights, (2) motor vehicles and other assets subject to certificates of title, (3) Commercial Tort Claims with a claimed amount of less than $50,000, (4) instruments representing or evidencing the Pledged Debt (other than Designated Pledged Debt) or (5) Pledged Interests (other than Designated Pledged Interests) or (z) perfect the security interest in certain Collateral in such circumstances where the Lender determines, in its reasonable discretion, that the cost of perfecting the security interest in such Collateral is excessive in relation to the practical benefit to the Lender obtained thereby (clauses (w), (x), (y) and (z)), collectively, the “Perfection Exceptions”). Section 3. Security for Obligations. This Agreement secures, in the case of each Grantor, the payment of all Obligations of such Grantor now or hereafter existing under the Loan Documents (as such Loan Documents may be amended, amended and restated, supplemented, replaced, refined or otherwise modified from time to time (including any increases of the principal amount outstanding thereunder)), whether direct or indirect, absolute or contingent, and whether for principal, reimbursement obligations, interest, fees, premiums, penalties, indemnifications, contract causes of action, costs, expenses or otherwise (all such Obligations being the “Secured Obligations”). Without limiting the generality of the foregoing, this Agreement secures, as to each Grantor, the payment of all amounts that constitute part of the Secured Obligations that would be owed by such Grantor to the Lender under the Loan Documents but for the fact that they are unenforceable or not allowable due to the effects of Debtor Relief Laws. Section 4. Grantors Remain Liable. Anything herein to the contrary notwithstanding, (a) each Grantor shall remain liable under the contracts and agreements included in such Grantor’s Collateral to the extent set forth therein to perform all of its duties and obligations thereunder to the same extent as if this Agreement had not been executed, (b) the exercise by the Lender of any of the rights hereunder shall not release any Grantor from any of its duties or obligations under the contracts and agreements included in the Collateral and (c) the Lender shall not have any obligation or liability under the contracts and agreements included in the Collateral by reason of this Agreement or any other Loan Document, nor shall the Lender be obligated to perform any of the obligations or duties of any Grantor thereunder or to take any action to collect or enforce any claim for payment assigned hereunder. Section 5. Delivery and Control of Security Collateral. Subject to the terms of the ABL Intercreditor Agreement, (a) all certificates, if any, representing or evidencing the Designated Pledged Interests and all instruments representing or evidencing the Designated Pledged Debt shall be delivered to and held by or on behalf of the Lender pursuant hereto and shall be in suitable form for transfer by delivery, or shall

7 be accompanied by duly executed instruments of transfer or assignment in blank, all in form and substance reasonably satisfactory to the Lender. Subject to the terms of the ABL Intercreditor Agreement, during the continuation of an Event of Default, the Lender shall have the right, at any time in its discretion and with notice to the Borrower (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such notice shall have automatically been deemed to have been given), to (i) transfer to or to register in the name of the Lender or any of its nominees any or all of the Security Collateral, subject only to the revocable rights specified in Section 11(a), (ii) exchange certificates or instruments representing or evidencing Security Collateral for certificates or instruments of smaller or larger denominations and (iii) convert Security Collateral consisting of Financial Assets credited to any Securities Account to Security Collateral consisting of Financial Assets held directly by the Lender, and to convert Security Collateral consisting of Financial Assets held directly by the Lender to Security Collateral consisting of Financial Assets credited to any Securities Account. (b) Subject to the terms of the ABL Intercreditor Agreement, during the continuation of an Event of Default, promptly upon the reasonable request of the Lender (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such request shall have automatically been deemed to have been given), with respect to any Security Collateral in which any Grantor has any right, title or interest and that constitutes an uncertificated security of a Subsidiary (but only to the extent that the issuer thereof is (a) wholly-owned by one or more Grantors and (b) organized under the laws of a State of the United States or the District of Columbia), such Grantor will cause the issuer thereof (at the option of the Lender (provided that, in the case of any deemed notice as a result of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, the Lender shall be deemed to have elected the option set forth in the following clause (b)(i))) either (i) to register the Lender as the registered owner of such security or (ii) to agree in an authenticated record with such Grantor and the Lender that such issuer will comply with instructions with respect to such security originated by the Lender without further consent of such Grantor, such authenticated record to be in form and substance reasonably satisfactory to the Lender. During the continuation of an Event of Default, with respect to any Security Collateral in which any Grantor has any right, title or interest and that is not an uncertificated security, promptly upon the request of the Lender (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such request shall have automatically been deemed to have been given), such Grantor will notify each issuer of the Designated Pledged Interests that such Pledged Interests are subject to the security interests granted hereunder. (c) With respect to any interest in any limited liability company or limited partnership constituting Security Collateral in which any Grantor has any right, title or interest, on the date hereof (after giving effect to the Transactions) or in the future, and that constitutes a “security” within the meaning of Article 8 of the UCC and is governed by Article 8 of the UCC (but only to the extent that the issuer thereof is (a) wholly-owned and (b) organized under the laws of a State of the United States or the District of Columbia), such Grantor agrees that (i) such interest shall be certificated and (ii) each such interest shall at all times hereafter continue to be such a security and represented by such certificate. With respect to any interest in any limited liability company or limited partnership constituting Security Collateral in which any Grantor has any right, title or interest, on the date hereof (after giving effect to the Transactions) or in the future, and that does not constitute a “security” within the meaning of Article 8 of the UCC (but only to the extent that the issuer thereof is (a) wholly-owned and (b) organized under the laws of a State of the United States or the District of Columbia), such Grantor shall at no time elect to treat any such interest as a “security” within the meaning of Article 8 of the UCC, nor shall such interest be represented by a certificate, unless such Grantor provides written notification to the Lender of such election and such interest is thereafter represented by a certificate that is promptly delivered to the Lender pursuant to the terms hereof. (d) During the continuation of an Event of Default, promptly upon the request of the Lender (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term

8 Loan Credit Agreement, such request shall have automatically been deemed to have been given), such Grantor will notify each issuer of the Designated Pledged Debt that such Pledged Debt is subject to the security interests granted hereunder. (e) Each Grantor shall use commercially reasonable efforts to obtain a Collateral Access Agreement from the lessor of each leased property, mortgagee of owned property or bailee or consignee with respect to any warehouse, processor or converter facility or other location where Collateral in excess of $50,000 is stored or located or deemed to be located, which agreement or letter shall provide access rights, contain a waiver or subordination of all Liens or claims that the landlord, mortgagee, bailee or consignee may assert against the Collateral at that location, and shall otherwise be reasonably satisfactory in form and substance to the Lender. Section 6. Electronic Chattel Paper, Transferable Records; Giving Notice of Commercial Tort Claims; Letter of Credit Rights. Subject to the terms of the ABL Intercreditor Agreement, so long as any Secured Obligation of any Loan Party under any Loan Document shall remain unpaid: (a) during the continuation of an Event of Default, promptly upon the request of the Lender (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such request shall have automatically been deemed to have been given), each Grantor will maintain all (i) Electronic Chattel Paper so that the Lender has control of such Electronic Chattel Paper in the manner specified in Section 9-105 of the UCC and (ii) all transferable records so that the Lender has control of such transferable records in the manner specified in Section 16 of the Uniform Electronic Transactions Act, as in effect in the jurisdiction governing such transferable record (“UETA”); (b) each Grantor will give prompt notice to the Lender of any individual Commercial Tort Claim with a claimed amount in excess of $50,000 that may arise after the date hereof and will promptly execute or otherwise authenticate a supplement to this Agreement and otherwise take all necessary action, to subject such Commercial Tort Claim to the security interest created under this Agreement; and (c) each Grantor, by granting a security interest in Letter of Credit Rights to the Lender, intends to (and hereby does) assign as collateral to the Lender its rights (including its contingent rights) to the proceeds of all such Letter of Credit Rights of which it is or hereafter becomes a beneficiary or assignee (it being understood that no actions shall be required to perfect a security interest in Letter of Credit Rights other than filing of a Uniform Commercial Code financing statement). Subject to the terms of the ABL Intercreditor Agreement, upon the occurrence and continuation of an Event of Default, each Grantor will, promptly upon written request by the Lender (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such written request shall have automatically been deemed to have been given), (i) notify (and such Grantor hereby authorizes the Lender to notify, upon written notice to such Grantor of its intention to do so) the issuer and each nominated person with respect to each of the letters of credit that the Letter of Credit Rights have been assigned to the Lender hereunder and any payments due or to become due in respect thereof are to be made directly to the Lender or its designee and (ii) arrange for the Lender to become the transferee beneficiary of such letter of credit. Section 7. Representations and Warranties. Each Grantor represents and warrants as follows (it being understood that none of the foregoing applies to the Excluded Assets): (a) as of the Closing Date (after giving effect to the Transactions), (i) such Grantor’s exact legal name, as defined in Section 9-503(a) of the UCC, type of organization, jurisdiction of organization or incorporation, organizational identification number (if any) and taxpayer identification number (if any), is correctly set forth on Schedule I hereto, (ii) such Grantor is located (within the meaning

9 of Section 9-307 of the UCC) and has its chief executive office, in the state or jurisdiction set forth on Schedule I hereto and (iii) such Grantor has no trade names other than as listed on Schedule I hereto and as of the Closing Date, within the five (5) years preceding the Closing Date, has not changed its name, location, chief executive office, type of organization, jurisdiction of organization or incorporation, organizational identification number (if any) or taxpayer identification number (if any) from those set forth on Schedule I, except as described on Schedule I; (b) as of the Closing Date (after giving effect to the Transactions), the Pledged Interests pledged by such Grantor and listed on Schedule II hereto constitute the percentage of the issued and outstanding Equity Interests of the issuers thereof indicated on Schedule II hereto; (c) (i) the operation of such Grantor’s business as currently conducted and the use of the Intellectual Property Collateral in connection therewith do not, to the knowledge of such Grantor, infringe upon or misappropriate the intellectual property rights of any third party; (ii) such Grantor is the exclusive owner of all right, title and interest in and to the Intellectual Property Collateral, or is entitled to use all Intellectual Property Collateral, subject only to the terms of the IP Agreements; (iii) as of the Closing Date (after giving effect to the Transactions), the Intellectual Property Collateral set forth on Schedule III hereto includes (A) all of the registered or applied for Patents, Trademarks and Copyrights owned by such Grantor and material to such Grantor’s business, (B) all domain names owned by any Grantor and material to such Grantor’s business, except for any domain names originated as a result of foreign intellectual property filings and (C) all IP Agreements pursuant to which any Grantor (x) is granted or obtains or agrees to grant or obtain from any other Person any right to use any material Intellectual Property Collateral or (y) permits or agrees to permit any other Person to use, enforce or register any material Intellectual Property Collateral owned by any Grantor; (iv) to such Grantor’s knowledge, Grantor has made or performed, or caused to be made or performed, all filings, recordings and other acts and has paid all required fees and taxes to maintain in full force and effect and protect its interest in each and every application and registration made by the previous owner for Intellectual Property Collateral owned by such Grantor, including, without limitation, recordations of any of its proprietary interests in United States Patents and United States Trademarks with the United States Patent and Trademark Office and recordation of any of its proprietary interests in United States Copyrights with the United States Copyright Office made by the previous owner; and such Grantor has used proper statutory notice in the same manner as the previous owner in connection with its use of each such Patent, Trademark and Copyright owned by such Grantor; (v) to such Grantor’s knowledge, (A) none of the Trade Secrets of such Grantor has been divulged, disclosed or appropriated to the detriment of such Grantor for the benefit of any Person other than such Grantor and (B) such Grantor has taken commercially reasonable measures to protect the confidentiality of such Grantor’s Trade Secret’s; (vi) to such Grantor’s knowledge, no Grantor or Intellectual Property Collateral is subject to (x) any claim, action, suit, investigation, litigation or proceeding alleging that the Grantor’s rights in or use of the Intellectual Property Collateral or that any services provided by, processes used by, or products manufactured or sold by, such Grantor infringe or otherwise

10 violate any patent, trademark, copyright or any other intellectual property right of any third party or (y) any outstanding consent, settlement, decree, order, injunction, judgment or ruling restricting the use of any Intellectual Property Collateral or that would impair the validity or enforceability of such Intellectual Property Collateral; and (d) such Grantor has no Commercial Tort Claims with an individual claimed value in excess of $50,000 on the Closing Date other than those listed in Schedule IV and additional Commercial Tort Claims as to which such Grantor has complied with the requirements of Section 6(b) hereof. Section 8. Further Assurances. (a) Each Grantor agrees that from time to time, at the request of the Lender and the expense of such Grantor, such Grantor will promptly execute and deliver, or otherwise authenticate, all further instruments and documents, and take all further action that may be necessary or that the Lender may reasonably request, in order to perfect and protect any pledge or security interest granted or purported to be granted by such Grantor hereunder or to enable the Lender to exercise and enforce its rights and remedies hereunder with respect to any Collateral of such Grantor, subject in each case to the Perfection Exceptions and the terms of the ABL Intercreditor Agreement. Without limiting the generality of the foregoing, subject to the terms of the ABL Intercreditor Agreement, each Grantor will, upon the Lender’s reasonable request, promptly with respect to Collateral of such Grantor: (i) if any such Collateral shall be evidenced by a promissory note or other instrument or Chattel Paper, deliver and pledge to the Lender hereunder such note or instrument or Chattel Paper duly indorsed and accompanied by duly executed instruments of transfer or assignment, all in form and substance reasonably satisfactory to the Lender; (ii) execute or authenticate and file such financing or continuation statements, or amendments thereto, and such other instruments or notices, as may be reasonably necessary or desirable, or as the Lender may reasonably request, in order to perfect and preserve the security interest granted or purported to be granted by such Grantor hereunder; notwithstanding anything to the contrary herein or in any Loan Document, the Grantors shall not have any obligation to perfect any security interest granted hereunder in any Intellectual Property Collateral in any jurisdiction other than the United States, any state thereof or the District of Columbia; and (iii) deliver and pledge to the Lender certificates representing Security Collateral consisting of Designated Pledged Interests or Designated Pledged Debt, in each case that constitutes certificated securities, accompanied by undated stock or bond powers executed in blank (to the extent required to be pledged pursuant to the Term Loan Credit Agreement or this Agreement). (b) Each Grantor hereby authorizes the Lender to file, at any time or from time to time, one or more UCC financing or continuation statements, and amendments thereto, including, without limitation, one or more UCC financing statements indicating that such financing statements cover all assets or all personal property, whether now owned or hereafter acquired (or words of similar effect) of such Grantor, in each case without the signature of such Grantor, and regardless of whether any particular asset described in such financing statements falls within the scope of the UCC or the granting clause of this Agreement. Section 9. Post-Closing Changes; Bailees; Collections on Assigned Agreements and Accounts. (a) Each Grantor will give prompt written notice to the Lender of any change in its exact legal name, as defined in Section 9-503(a) of the UCC, type of organization, jurisdiction of organization or incorporation, organizational identification number (if any) and taxpayer identification number (if any) from those set forth in Schedule I (provided that such written notice shall be given no later than five (5) Business Days (or such later date as may be agreed by the Lender) after such change) and will take all action reasonably required by the Lender for the purpose of perfecting or protecting the security interest granted by this Agreement. (b) Subject to the terms of the ABL Intercreditor Agreement, during the continuation of an Event of Default, if Collateral of any Grantor is at any time in the possession or control of a

11 warehouseman, bailee or agent, upon the request of the Lender (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such request shall have automatically been deemed to have been given) such Grantor will (i) notify such warehouseman, bailee or agent of the security interest created hereunder, (ii) instruct such warehouseman, bailee or agent to hold all such Collateral solely for the Lender’s account subject only to the Lender’s instructions, (iii) use commercially reasonable efforts to cause such warehouseman, bailee or agent to authenticate a record (in form and substance reasonably satisfactory to the Lender) acknowledging that it holds possession of such Collateral for the Lender’s benefit and shall act solely on the instructions of the Lender without the further consent of the Grantor or any other Person and (iv) if obtained, make such authenticated record available to the Lender. (c) Except as otherwise provided in this Section 9(c), each Grantor may continue to collect, at its own expense, in its sole discretion, all amounts due or to become due such Grantor under its Accounts. In connection with such collections, such Grantor may take (and, subject to the terms of the ABL Intercreditor Agreement, at the Lender’s direction during the continuation of an Event of Default, shall take) such commercially reasonable action as such Grantor (or during the continuation of an Event of Default, the Lender) may deem necessary or advisable to enforce collection thereof; provided, however, that, subject to the terms of the ABL Intercreditor Agreement, the Lender shall have the right at any time upon the occurrence and during the continuance of an Event of Default and upon written notice to such Grantor of its intention to do so (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such notice shall have automatically been deemed to have been given), to notify the obligors under any Accounts, of the assignment of such Accounts to the Lender and to direct such obligors to make payment of all amounts due or to become due to such Grantor thereunder directly to the Lender and, upon such notification and at the expense of such Grantor, to enforce collection of any such Accounts, to adjust, settle or compromise the amount or payment thereof, in the same manner and to the same extent as such Grantor might have done, and to otherwise exercise all rights with respect to such Accounts, including, without limitation, those set forth set forth in Section 9- 607 of the UCC. After receipt by any Grantor of written notice (provided that such written notice shall not be required in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement) from the Lender and during the continuation of an Event of Default, (i) all amounts and proceeds (including, without limitation, instruments) received by such Grantor in respect of the Accounts, of such Grantor shall be received in trust for the benefit of the Lender hereunder, shall be segregated from other funds of such Grantor and shall be either (A) released to such Grantor to the extent permitted under the terms of the Term Loan Credit Agreement to the extent an Event of Default no longer shall be continuing or (B) if any Event of Default shall be continuing, applied as provided in Section 8.03 of the Term Loan Credit Agreement and (ii) except with the consent of the Lender, such consent not to be unreasonably withheld, such Grantor will not adjust, settle or compromise the amount or payment of any Account, release wholly or partly any obligor thereof, or allow any credit or discount thereon. Section 10. As to Intellectual Property Collateral. (a) With respect to each item of its Registered Intellectual Property Collateral owned by a Grantor, except as otherwise provided in the Term Loan Credit Agreement, each Grantor agrees to take, at its expense, commercially reasonable steps in the United States, including, without limitation, in the United States Patent and Trademark Office, the United States Copyright Office and any other domestic governmental authority, as applicable, to (i) maintain the validity and enforceability of such Registered Intellectual Property Collateral and maintain such Registered Intellectual Property Collateral in full force and effect, and (ii) pursue the registration (to the extent registrable) and maintenance of each application and registration for any Patent, Trademark or Copyright owned by such Grantor, now or hereafter included in such Registered Intellectual Property Collateral, including, without limitation, the payment of required fees and taxes, the filing of responses to office actions issued by the United States Patent and Trademark Office, the United States Copyright Office and any other domestic governmental authority, as applicable, the filing of applications for renewal or extension, the filing

12 of affidavits under Sections 8 and 15 of the U.S. Trademark Act, the filing of divisional, continuation, continuation-in-part, reissue and renewal applications or extensions, the payment of maintenance fees and the participation in interference, reexamination, opposition, cancellation, infringement and misappropriation proceedings, except, in each case, as permitted by the Loan Documents. (b) Except where permitted by the Loan Documents, each Grantor shall use proper statutory notice in connection with its use of owned Intellectual Property Collateral that is material to the business of the Borrower and its Subsidiaries. Except where permitted by the Loan Documents, no Grantor shall do or permit any act or knowingly omit to do any act whereby any of its owned Intellectual Property Collateral may lapse or become invalid or unenforceable or placed in the public domain. (c) [Reserved.] (d) With respect to Registered Intellectual Property Collateral owned by each Grantor, such Grantor agrees to execute or otherwise authenticate an agreement, in substantially the form set forth in Exhibit B hereto or otherwise in form and substance reasonably satisfactory to the Lender (an “Intellectual Property Security Agreement”), for recording the security interest granted hereunder to the Lender in such Registered Intellectual Property Collateral with the United States Patent and Trademark Office, the United States Copyright Office or any other domestic governmental authorities necessary to perfect the security interest granted hereunder in any registered or applied-for United States Registered Intellectual Property Collateral, as applicable. (e) Without limiting Section 2, each Grantor agrees that should it obtain an ownership interest in any Registered Intellectual Property Collateral that is not, as of the Closing Date, a part of the Registered Intellectual Property Collateral (“After-Acquired Intellectual Property”) (i) the provisions of this Agreement shall automatically apply thereto, and (ii) any such After-Acquired Intellectual Property and, in the case of trademarks, the goodwill symbolized thereby, shall automatically become part of the Registered Intellectual Property Collateral subject to the terms and conditions of this Agreement with respect thereto. Each Grantor shall, concurrently with the delivery of financial statements under Section 6.01(a) and (b) of the Term Loan Credit Agreement (or such later date as agreed to by the Lender in its reasonable discretion), execute and deliver to the Lender, or otherwise authenticate, an agreement substantially in the form of Exhibit C hereto or otherwise in form and substance reasonably satisfactory to the Lender (an “IP Security Agreement Supplement”) covering such After-Acquired Intellectual Property, if any, which, at the request of the Lender, shall be recorded with (or which, at the option of the Grantor, the Lender shall be authorized to record with) the United States Patent and Trademark Office or the United States Copyright Office to perfect the security interest granted hereunder in any registered or applied-for United States After-Acquired Intellectual Property, as applicable. Section 11. Voting Rights; Dividends; Etc. (a) So long as no Event of Default shall have occurred and be continuing, and after the occurrence of an Event of Default but prior to an Equity Rights Shift Date: (i) each Grantor shall be entitled to exercise any and all voting and other consensual rights pertaining to the Security Collateral of such Grantor or any part thereof for any purpose; provided, however, that such Grantor will not exercise or refrain from exercising any such right in a manner prohibited by the Term Loan Credit Agreement; (ii) each Grantor shall be entitled to receive and retain any and all dividends, interest and other distributions paid in respect of the Security Collateral of such Grantor if and to the extent that the payment thereof is not otherwise prohibited by the terms of the Loan Documents; provided, however, that (x) any non-cash dividends in respect thereof, including any rights to

13 receive the same to the extent not so distributed or paid, that would constitute Pledged Interests, whether resulting from a subdivision, combination or reclassification of the outstanding Equity Interests of the issuer of any Pledged Interests, received in exchange for Pledged Interests or any part thereof, or in redemption thereof, as a result of any merger, consolidation, acquisition or other exchange of assets to which such issuer may be a party or otherwise and (y) any non-cash dividends and other non-cash distributions or payments paid or payable in respect of any Pledged Interests that would constitute Pledged Interests in connection with a partial or total liquidation or dissolution or in connection with a reduction of capital, capital surplus or paid in surplus, shall be and become part of the Pledged Interests, as applicable, and, if received by any Grantor, and to the extent constituting Designated Pledged Interests, such Grantor shall deliver and pledge to the Lender such Designated Pledged Interests in accordance with Section 8(a)(iii); and (iii) The Lender will execute and deliver (or cause to be executed and delivered) to each Grantor all such proxies and other instruments as such Grantor may reasonably request for the purpose of enabling such Grantor to exercise the voting and other rights that it is entitled to exercise pursuant to paragraph (i) above and to receive the dividends or interest payments that it is authorized to receive and retain pursuant to paragraph (ii) above. (b) Subject to the terms of the ABL Intercreditor Agreement, upon the occurrence and during the continuance of an Event of Default: (i) upon notice to the applicable Grantor, and automatically in the case of clause (y) below to the extent such Event of Default is under Section 8.01(f) or (g) of the Term Loan Credit Agreement (the date of such notice, or of such Event of Default under Section 8.01(f) or (g) of the Term Loan Credit Agreement, the “Equity Rights Shift Date”), all rights of each Grantor (x) to exercise or refrain from exercising the voting and other consensual rights that it would otherwise be entitled to exercise pursuant to Section 11(a)(i) shall, upon notice to such Grantor by the Lender, cease and (y) to receive the dividends, interest and other distributions that it would otherwise be authorized to receive and retain pursuant to Section 11(a)(ii) shall cease, and all such rights shall thereupon become vested in the Lender, which shall thereupon have the sole right to exercise or refrain from exercising such voting and other consensual rights and to receive and hold as Security Collateral such dividends, interest and other distributions; and (ii) all dividends, interest and other distributions that are received by any Grantor contrary to the provisions of paragraph (i) of this Section 11(b) shall be received in trust for the benefit of the Lender, shall be segregated from other funds of such Grantor and shall be forthwith paid over to the Lender as Security Collateral in the same form as so received (with any necessary indorsement). Section 12. Lender Appointed Attorney-in-Fact. Subject to the terms of the ABL Intercreditor Agreement, each Grantor hereby irrevocably appoints the Lender such Grantor’s attorney-in- fact, with full authority in the place and stead of such Grantor and in the name of such Grantor or otherwise, from time to time, upon the occurrence and during the continuance of an Event of Default, in the Lender’s discretion, to do any or all of the following that the Lender may deem necessary or advisable to accomplish the purposes of this Agreement: (a) to obtain and adjust insurance required to be paid to the Lender; (b) to ask for, demand, collect, sue for, recover, compromise, receive and give acquittance and receipts for moneys due and to become due under or in respect of any of the Collateral;

14 (c) to receive, indorse and collect any drafts or other instruments, documents and Chattel Paper, in connection with clause (a) or (b) above; (d) to exercise any of such Grantor’s rights under the ABL Credit Agreement, including, without limitation, the direction of any disposition of funds to which such Grantor is entitled thereunder; and (e) to file any claims or take any action or institute any proceedings that the Lender may deem necessary or desirable for the collection of any of the Collateral or otherwise to enforce compliance with the terms and conditions of any Assigned Agreement or the rights of the Lender with respect to any of the Collateral. Section 13. Lender May Perform. If any Grantor fails to perform any agreement contained herein, the Lender may, after providing notice to such Grantor of its intent to do so (provided that, in the case of an Event of Default pursuant to Sections 8.01(f) or (g) of the Term Loan Credit Agreement, such notice shall have automatically been deemed to have been given), but without any obligation to do so, itself perform, or cause performance of, such agreement, and the expenses of the Lender incurred in connection therewith shall be payable by such Grantor pursuant to Section 10.04 of the Term Loan Credit Agreement. Section 14. The Lender’s Duties. The powers conferred on the Lender hereunder are solely to protect the Lender’s interest in the Collateral and shall not impose any duty upon it to exercise any such powers. Except for the exercise of reasonable care with respect to the custody of any Collateral in its possession and the accounting for moneys actually received by it hereunder, the Lender shall have no duty as to any Collateral, as to ascertaining or taking action with respect to calls, conversions, exchanges, maturities, tenders or other matters relative to any Collateral, whether or not the Lender has or is deemed to have knowledge of such matters, or as to the taking of any necessary steps to preserve rights against any parties or any other rights pertaining to any Collateral. The Lender shall be deemed to have exercised reasonable care in the custody and preservation of any Collateral in its possession if such Collateral is accorded treatment substantially equal to that which it accords its own property. Section 15. Remedies. If any Event of Default shall have occurred and be continuing, subject to the terms herein and to the terms of the ABL Intercreditor Agreement: (a) The Lender may exercise in respect of the Collateral, in addition to other rights and remedies provided for herein or otherwise available to it, all the rights and remedies of a Lender upon default under the UCC (whether or not the UCC applies to the affected Collateral) and also may: (i) require each Grantor to, and each Grantor hereby agrees that it will at its expense and upon request of the Lender forthwith, assemble all or part of the Collateral as directed by the Lender and make it available to the Lender at a place and time to be designated by the Lender that is reasonably convenient to both parties; (ii) without notice except as specified below, but subject to pre-existing rights and licenses, sell the Collateral or any part thereof in one or more parcels at public or private sale, at any of the Lender’s offices or elsewhere, for cash, on credit or for future delivery, and upon such other terms as are commercially reasonable, as determined by the Lender, and, to the extent applicable, in accordance with the provisions of the UCC; (iii) occupy any premises owned or leased by any of the Grantors where the Collateral or any part thereof is assembled or located for a reasonable period in order to effectuate its rights and remedies hereunder or under law, without obligation to such Grantor in respect of such occupation; and (iv) to the maximum extent permitted by applicable law, exercise any and all rights and remedies of any of the Grantors under or in connection with the Collateral, or otherwise in respect of the Collateral, including, without limitation, (A) any and all rights of such Grantor to demand or otherwise require payment of any amount under, or performance of any provision of, the Assigned Agreements, the Accounts and the other Collateral, and

15 (B) exercise all other rights and remedies with respect to the Assigned Agreements, the Accounts and the other Collateral, including, without limitation, those set forth in Section 9-607 of the UCC. Each Grantor agrees that, to the extent notice of sale shall be required by law, to the maximum extent permitted by applicable law, at least ten (10) days’ notice to such Grantor of the time and place of any public sale or the time after which any private sale is to be made shall constitute reasonable notification. To the maximum extent permitted by applicable law, the Lender shall not be obligated to make any sale of Collateral regardless of notice of sale having been given. The Lender may adjourn any public or private sale from time to time by announcement at the time and place fixed therefor, and such sale may, without further notice, be made at the time and place to which it was so adjourned. (b) All payments received by any Grantor under or in connection with any Assigned Agreement or otherwise in respect of the Collateral shall be received in trust for the benefit of the Lender, shall be segregated from other funds of such Grantor and shall be forthwith paid over to the Lender in the same form as so received (with any necessary indorsement). (c) The Lender may, during the continuation of an Event of Default pursuant to the Term Loan Credit Agreement, without notice to any Grantor except as required by law and at any time or from time to time, charge, set-off and otherwise apply all or any part of the Secured Obligations against any funds held with respect to any Deposit Account. (d) Any cash held by or on behalf of the Lender and all cash proceeds received by or on behalf of the Lender in respect of any sale of, collection from, or other realization upon all or any part of the Collateral may, in the discretion of the Lender, be held by the Lender as collateral for, and/or then or at any time thereafter applied (after payment of any amounts payable to the Lender pursuant Section 10.04 of the Term Loan Credit Agreement) in whole or in part by the Lender against, all or any part of the Secured Obligations, in the manner set forth in Section 8.03 of the Term Loan Credit Agreement. (e) If the Lender shall determine to exercise its right to sell all or any of the Security Collateral of any Grantor pursuant to this Section 15, each Grantor agrees that, upon request of the Lender, such Grantor will, subject to pre-existing rights and licenses, at its own expense, use its reasonable best efforts to do or cause to be done all such other acts and things as may be necessary to make such sale of such Security Collateral or any part thereof valid and binding and in compliance with applicable law. (f) Subject to compliance with applicable law, including the Securities Act of 1933 and the Exchange Act and all rules and regulations thereunder, the Lender is authorized, in connection with any sale of the Security Collateral pursuant to this Section 15, to deliver or otherwise disclose to any prospective purchaser of the Security Collateral: (i) any registration statement or prospectus, and all supplements and amendments thereto; (ii) information and projections and (iii) any other information in its possession relating to such Security Collateral. (g) Each Grantor acknowledges the impossibility of ascertaining the amount of damages that would be suffered by the Lender by reason of the failure by such Grantor to perform any of the covenants contained in Section 15(f) above and, consequently, agrees that Section 15(f) shall be specifically enforceable against such Grantor. Section 16. Amendments; Waivers; Additional Grantors; Etc. (a) Subject to Section 10.01 of the Term Loan Credit Agreement, no amendment or waiver of any provision of this Agreement, and no consent to any departure by any Grantor herefrom, shall in any event be effective unless the same shall be in writing and signed by the Lender and the Grantors, and then such amendment, waiver or consent shall be effective only in the specific instance and for the specific purpose for which given. No failure on the part of the Lender to exercise, and no delay in exercising any right hereunder, shall operate

16 as a waiver thereof; nor shall any single or partial exercise of any such right preclude any other or further exercise thereof or the exercise of any other right. (b) Upon the execution and delivery, or authentication, by any Person of a security agreement supplement in substantially the form of Exhibit A hereto (each a “Security Agreement Supplement”), (i) such Person shall be referred to as an “Additional Grantor” and shall be and become a Grantor hereunder, and each reference in this Agreement and the other Loan Documents to “Grantor” shall also mean and be a reference to such Additional Grantor, and each reference in this Agreement and the other Loan Documents to “Collateral” shall also mean and be a reference to the Collateral of such Additional Grantor, and (ii) the supplemental schedules I through V attached to each Security Agreement Supplement shall be incorporated into and become a part of and supplement Schedules I through V, respectively, hereto, and the Lender may attach such supplemental schedules to such Schedules; and each reference to such Schedules shall mean and be a reference to such Schedules as supplemented pursuant to each Security Agreement Supplement. Section 17. Notices, Etc. All notices and other communications provided for hereunder shall be in writing (including telegraphic, telecopy or telex communication or facsimile transmission) and mailed, telegraphed, telecopied, telexed, faxed, emailed or delivered to it, if to any Grantor, addressed to it in care of the Borrower at the Borrower’s address specified in Section 10.02 of the Term Loan Credit Agreement, if to the Lender, at its address specified in Section 10.02 of the Term Loan Credit Agreement. All such notices and other communications shall be deemed to be given or made at such time as shall be set forth in Section 10.02 of the Term Loan Credit Agreement. Delivery by telecopier or in .pdf or similar format by electronic mail of an executed counterpart of any amendment or waiver of any provision of this Agreement or of any Security Agreement Supplement or Schedule hereto shall be effective as delivery of an original executed counterpart thereof. Section 18. Continuing Security Interest; Assignments under the Term Loan Credit Agreement. This Agreement shall create a continuing security interest in the Collateral and shall to the extent provided herein (a) remain in full force and effect until the payment in full in cash of the Secured Obligations, (b) be binding upon each Grantor, its successors and assigns and (c) inure, together with the rights and remedies to the benefit of the Lender and its successors and permitted transferees and assigns. Without limiting the generality of the foregoing clause (c), the Lender may assign or otherwise transfer all or any portion of its rights and obligations under the Term Loan Credit Agreement (including, without limitation, all or any portion of its Term Loans owing to it and the Term Note, held by it) to any other Person, and such other Person shall thereupon become vested with all the benefits in respect thereof granted to such Lender herein or otherwise, in each case as provided in Section 10.07 of the Term Loan Credit Agreement. Section 19. Release; Termination. (a) Upon (x) any sale, lease, transfer or other disposition of any item of Collateral of any Grantor permitted by, and in accordance with, the terms of the Loan Documents (other than to another Loan Party or to a Person becoming or required to become a Loan Party at the time of such sale, lease, transfer or other disposition), or (y) any transaction permitted by, and in accordance with, the terms of the Loan Documents, resulting in a Grantor owning any Collateral becoming an Excluded Subsidiary or being released from its obligations under the Guaranty, in each case, the assignment, pledge and security interest granted hereby with respect to such collateral shall automatically terminate and all rights to such Collateral shall revert to such Grantor and the Lender will, at such Grantor’s expense, execute and deliver to such Grantor such documents as such Grantor shall reasonably request to evidence the release of such item of Collateral from the assignment, pledge and security interest granted hereby; provided, however, that, if requested by the Lender, such Grantor shall have delivered to the Lender a written request for release, together with a form of release for execution by

17 the Lender, a certificate of such Grantor to the effect that the transaction is in compliance with the Loan Documents and such other supporting information as the Lender may reasonably request. (b) Upon the termination of the payment in full in cash of the Secured Obligations, the pledge and security interests granted hereby shall automatically terminate and all rights to the Collateral shall revert to the applicable Grantor. Upon any such termination, the Lender will, at the applicable Grantor’s expense, execute and deliver to such Grantor such documents as such Grantor shall reasonably request to evidence such termination. Section 20. Execution in Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement in .pdf or similar format by electronic mail shall be effective as delivery of an original executed counterpart of this Agreement. Section 21. The Mortgages. In the event that any of the Collateral hereunder is also subject to a valid and enforceable Lien under the terms of any Mortgage and the terms of such Mortgage are inconsistent with the terms of this Agreement, then with respect to such Collateral, the terms of such Mortgage shall be controlling (other than with respect to personal property constituting Collateral pursuant to Section 2 hereof) in the case of fixtures and real estate leases, letting and licenses of, and contracts and agreements relating to the lease of, real property, and the terms of this Agreement shall be controlling in the case of all other Collateral. Section 22. Governing Law; Jurisdiction; Etc. (a) GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. (b) SUBMISSION TO JURISDICTION. EACH PARTY HERETO IRREVOCABLY AND UNCONDITIONALLY SUBMITS FOR ITSELF AND ITS PROPERTY IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS AGREEMENT TO THE EXCLUSIVE GENERAL JURISDICTION OF THE SUPREME COURT OF THE STATE OF NEW YORK FOR THE COUNTY OF NEW YORK (THE “NEW YORK SUPREME COURT”), AND THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK (THE “FEDERAL DISTRICT COURT,” AND TOGETHER WITH THE NEW YORK SUPREME COURT, THE “NEW YORK COURTS”) AND APPELLATE COURTS FROM EITHER OF THEM; PROVIDED THAT NOTHING IN THIS AGREEMENT SHALL BE DEEMED OR OPERATE TO PRECLUDE (I) THE LENDER FROM BRINGING SUIT OR TAKING OTHER LEGAL ACTION IN ANY OTHER JURISDICTION TO REALIZE ON THE COLLATERAL OR ANY OTHER SECURITY FOR THE OBLIGATIONS (IN WHICH CASE ANY PARTY SHALL BE ENTITLED TO ASSERT ANY CLAIM OR DEFENSE, INCLUDING ANY CLAIM OR DEFENSE THAT THIS SECTION 22 WOULD OTHERWISE REQUIRE TO BE ASSERTED IN A LEGAL ACTION OR PROCEEDING IN A NEW YORK COURT), OR TO ENFORCE A JUDGMENT OR OTHER COURT ORDER IN FAVOR OF THE LENDER, (II) ANY PARTY FROM BRINGING ANY LEGAL ACTION OR PROCEEDING IN ANY JURISDICTION FOR THE RECOGNITION AND ENFORCEMENT OF ANY JUDGMENT, (III) IF ALL SUCH NEW YORK COURTS DECLINE JURISDICTION OVER ANY PERSON, OR DECLINE (OR, IN THE CASE OF THE FEDERAL DISTRICT COURT, LACK) JURISDICTION OVER ANY SUBJECT MATTER OF SUCH ACTION OR PROCEEDING, A LEGAL ACTION OR PROCEEDING MAY BE BROUGHT WITH RESPECT THERETO IN ANOTHER COURT HAVING JURISDICTION AND (IV) IN THE EVENT A LEGAL ACTION OR PROCEEDING IS BROUGHT AGAINST ANY PARTY HERETO OR INVOLVING ANY OF ITS ASSETS OR PROPERTY IN ANOTHER COURT (WITHOUT ANY COLLUSIVE ASSISTANCE BY SUCH PARTY OR ANY OF ITS SUBSIDIARIES

18 OR AFFILIATES), SUCH PARTY FROM ASSERTING A CLAIM OR DEFENSE (INCLUDING ANY CLAIM OR DEFENSE THAT THIS SECTION 22 WOULD OTHERWISE REQUIRE TO BE ASSERTED IN A LEGAL ACTION OR PROCEEDING IN A NEW YORK COURT) IN ANY SUCH ACTION OR PROCEEDING. (c) EACH PARTY HERETO IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY OBJECTION THAT IT MAY NOW OR HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT IN ANY COURT REFERRED TO IN SECTION 22(B). EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH ACTION OR PROCEEDING IN ANY SUCH COURT. (d) EACH PARTY HERETO IRREVOCABLY CONSENTS TO SERVICE OF PROCESS IN THE MANNER PROVIDED FOR NOTICES IN SECTION 10.02 OF THE TERM LOAN CREDIT AGREEMENT. NOTHING IN THIS AGREEMENT WILL AFFECT THE RIGHT OF ANY PARTY HERETO TO SERVE PROCESS IN ANY OTHER MANNER PERMITTED BY APPLICABLE LAW. (e) EACH PARTY TO THIS AGREEMENT HEREBY EXPRESSLY WAIVES ANY RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION OR CAUSE OF ACTION ARISING UNDER THIS AGREEMENT OR IN ANY WAY CONNECTED WITH OR RELATED OR INCIDENTAL TO THE DEALINGS OF THE PARTIES HERETO OR ANY OF THEM WITH RESPECT TO THIS AGREEMENT, OR THE TRANSACTIONS RELATED HERETO, IN EACH CASE WHETHER NOW EXISTING OR HEREAFTER ARISING, AND WHETHER FOUNDED IN CONTRACT OR TORT OR OTHERWISE; AND EACH PARTY HEREBY AGREES AND CONSENTS THAT ANY SUCH CLAIM, DEMAND, ACTION OR CAUSE OF ACTION SHALL BE DECIDED BY COURT TRIAL WITHOUT A JURY, AND THAT ANY PARTY TO THIS AGREEMENT MAY FILE AN ORIGINAL COUNTERPART OR A COPY OF THIS SECTION 22(E) WITH ANY COURT AS WRITTEN EVIDENCE OF THE CONSENT OF THE SIGNATORIES HERETO TO THE WAIVER OF THEIR RIGHT TO TRIAL BY JURY. Section 23. Intercreditor Agreement. The terms of this Agreement, any Lien granted to the Lender or otherwise pursuant to this Agreement or the other Loan Documents and the exercise of any right or remedy by the Lender hereunder are subject to the provisions of the ABL Intercreditor Agreement. In the event of any inconsistency between the provisions of this Agreement and the ABL Intercreditor Agreement, the provisions of the ABL Intercreditor Agreement shall supersede the provisions of this Agreement. Without limiting the generality of the foregoing, and notwithstanding anything herein to the contrary, all rights and remedies of the Lender hereunder shall be subject to the terms of the ABL Intercreditor Agreement. [Signature Pages Follow.]

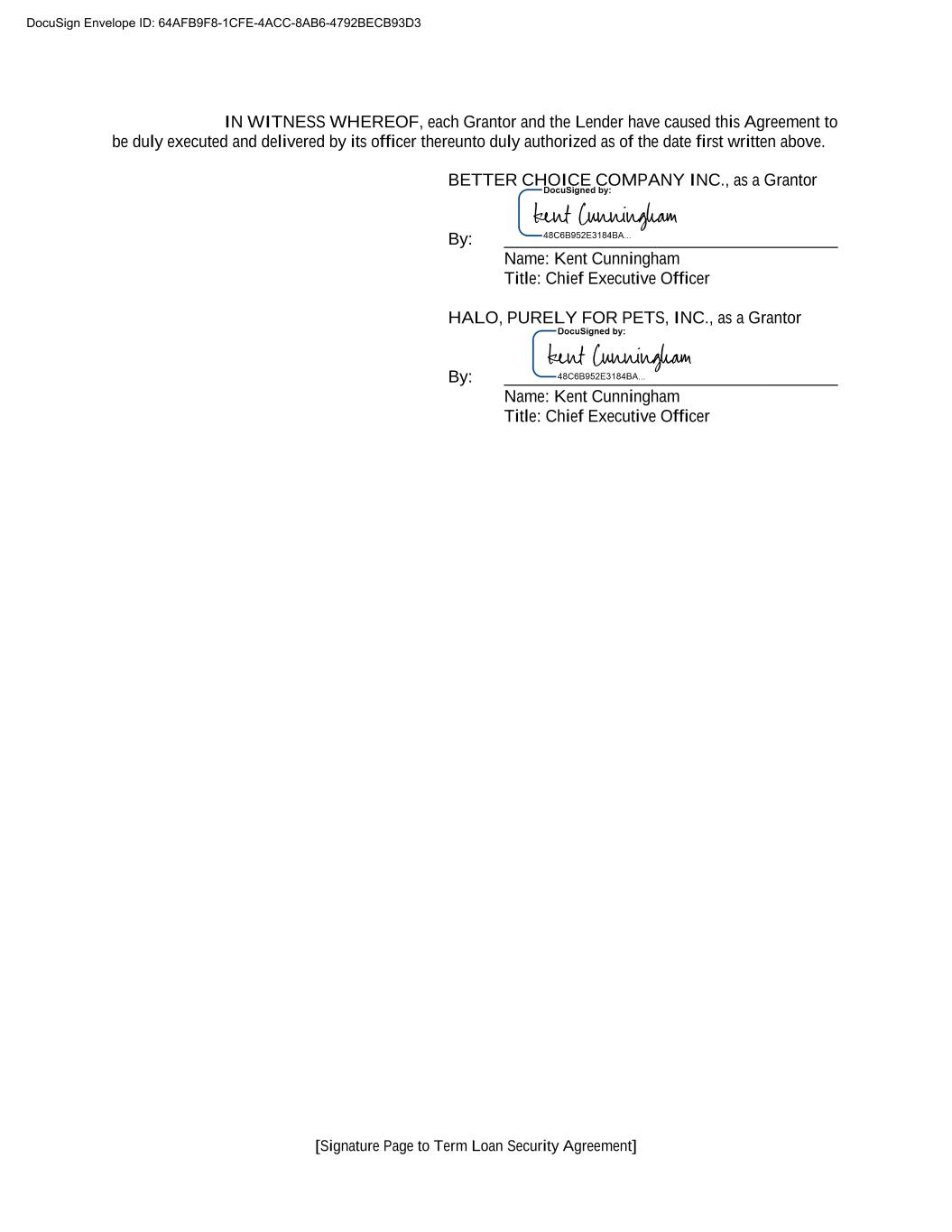

[Signature Page to Term Loan Security Agreement] IN WITNESS WHEREOF, each Grantor and the Lender have caused this Agreement to be duly executed and delivered by its officer thereunto duly authorized as of the date first written above. BETTER CHOICE COMPANY INC., as a Grantor By: _______________________________________ Name: Kent Cunningham Title: Chief Executive Officer HALO, PURELY FOR PETS, INC., as a Grantor By: _______________________________________ Name: Kent Cunningham Title: Chief Executive Officer DocuSign Envelope ID: 64AFB9F8-1CFE-4ACC-8AB6-4792BECB93D3

[Signature Page to Term Loan Security Agreement] ALPHIA INC., as Lender By: ____________________________________ Name: Title: David McLain Chief Executive Officer

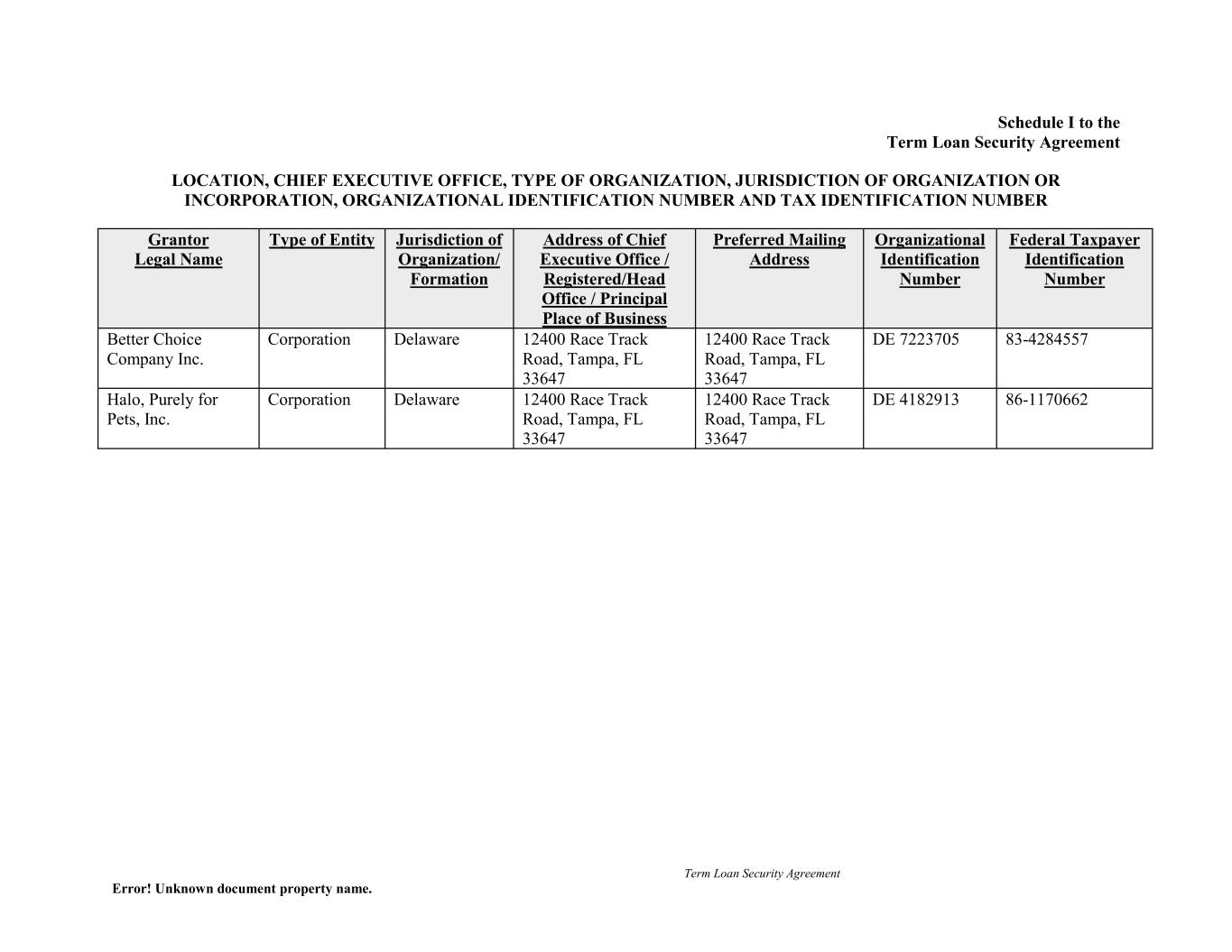

Term Loan Security Agreement Error! Unknown document property name. Schedule I to the Term Loan Security Agreement LOCATION, CHIEF EXECUTIVE OFFICE, TYPE OF ORGANIZATION, JURISDICTION OF ORGANIZATION OR INCORPORATION, ORGANIZATIONAL IDENTIFICATION NUMBER AND TAX IDENTIFICATION NUMBER Grantor Legal Name Type of Entity Jurisdiction of Organization/ Formation Address of Chief Executive Office / Registered/Head Office / Principal Place of Business Preferred Mailing Address Organizational Identification Number Federal Taxpayer Identification Number Better Choice Company Inc. Corporation Delaware 12400 Race Track Road, Tampa, FL 33647 12400 Race Track Road, Tampa, FL 33647 DE 7223705 83-4284557 Halo, Purely for Pets, Inc. Corporation Delaware 12400 Race Track Road, Tampa, FL 33647 12400 Race Track Road, Tampa, FL 33647 DE 4182913 86-1170662

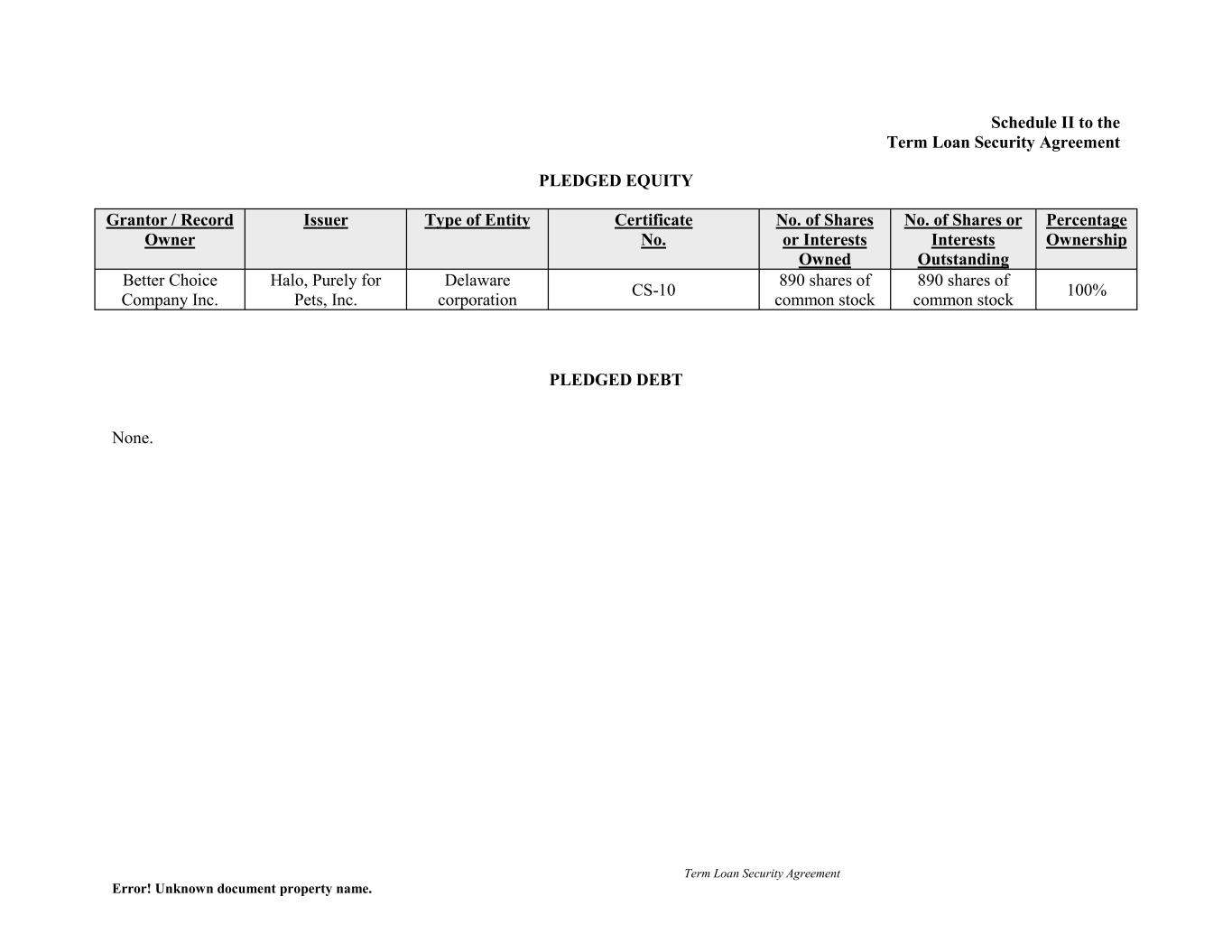

Term Loan Security Agreement Error! Unknown document property name. Schedule II to the Term Loan Security Agreement PLEDGED EQUITY Grantor / Record Owner Issuer Type of Entity Certificate No. No. of Shares or Interests Owned No. of Shares or Interests Outstanding Percentage Ownership Better Choice Company Inc. Halo, Purely for Pets, Inc. Delaware corporation CS-10 890 shares of common stock 890 shares of common stock 100% PLEDGED DEBT None.

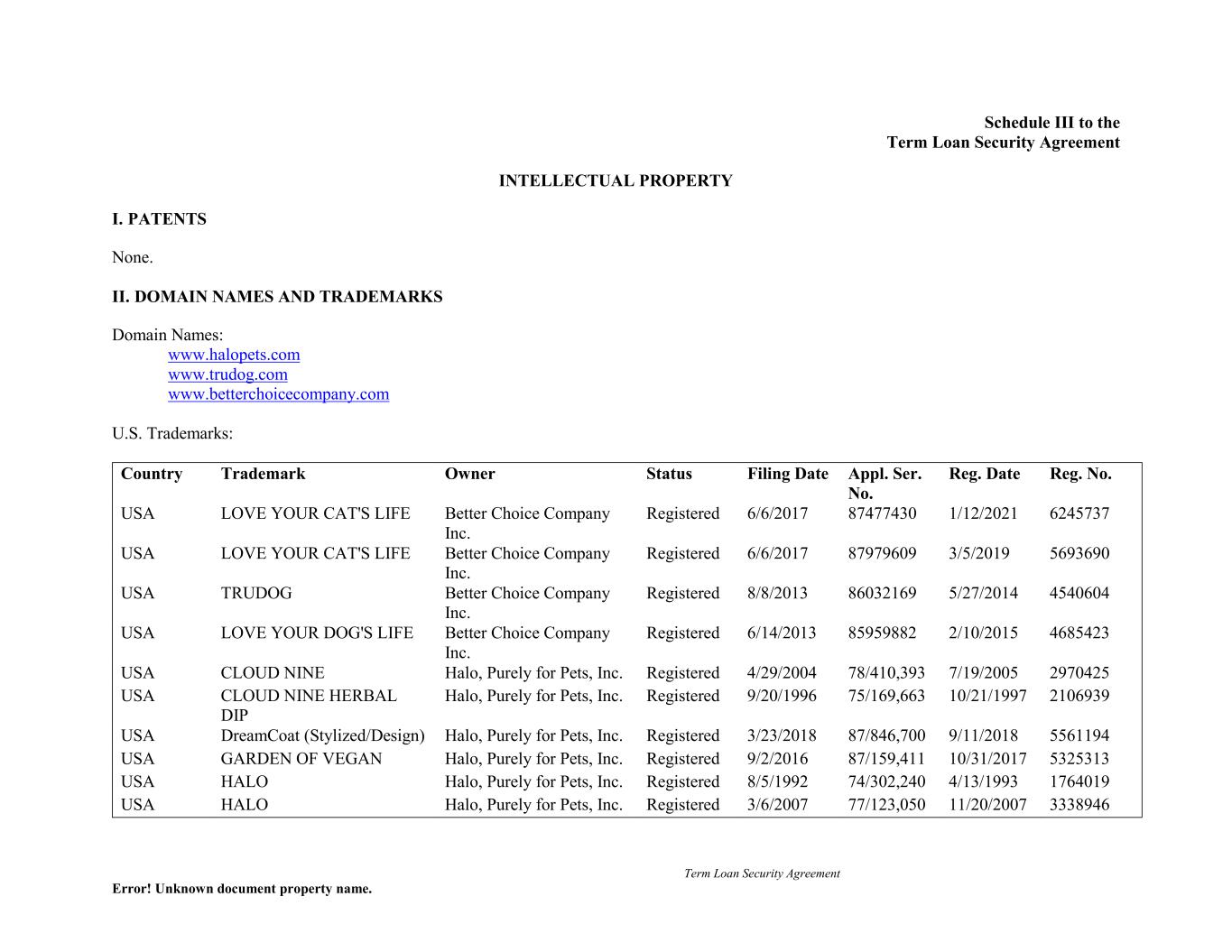

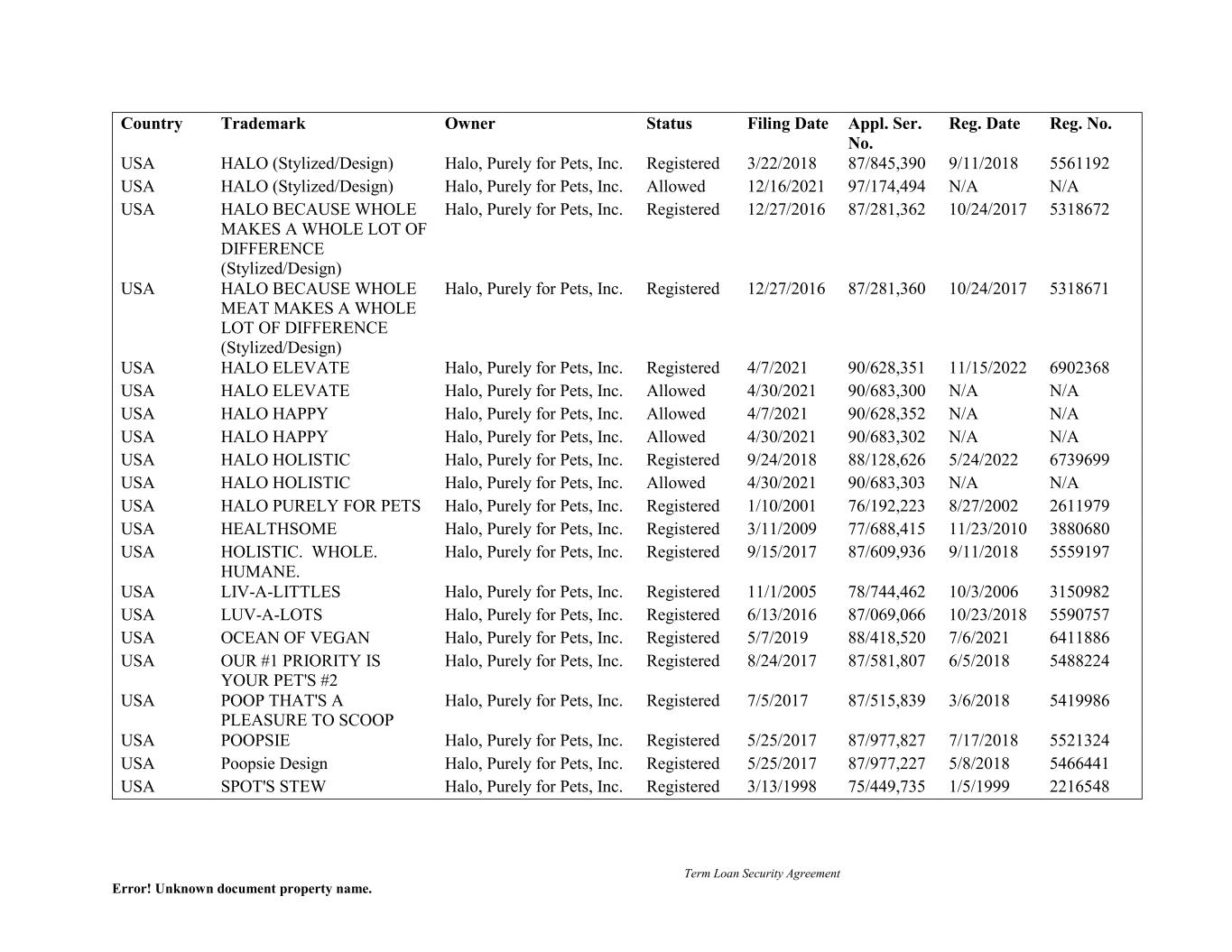

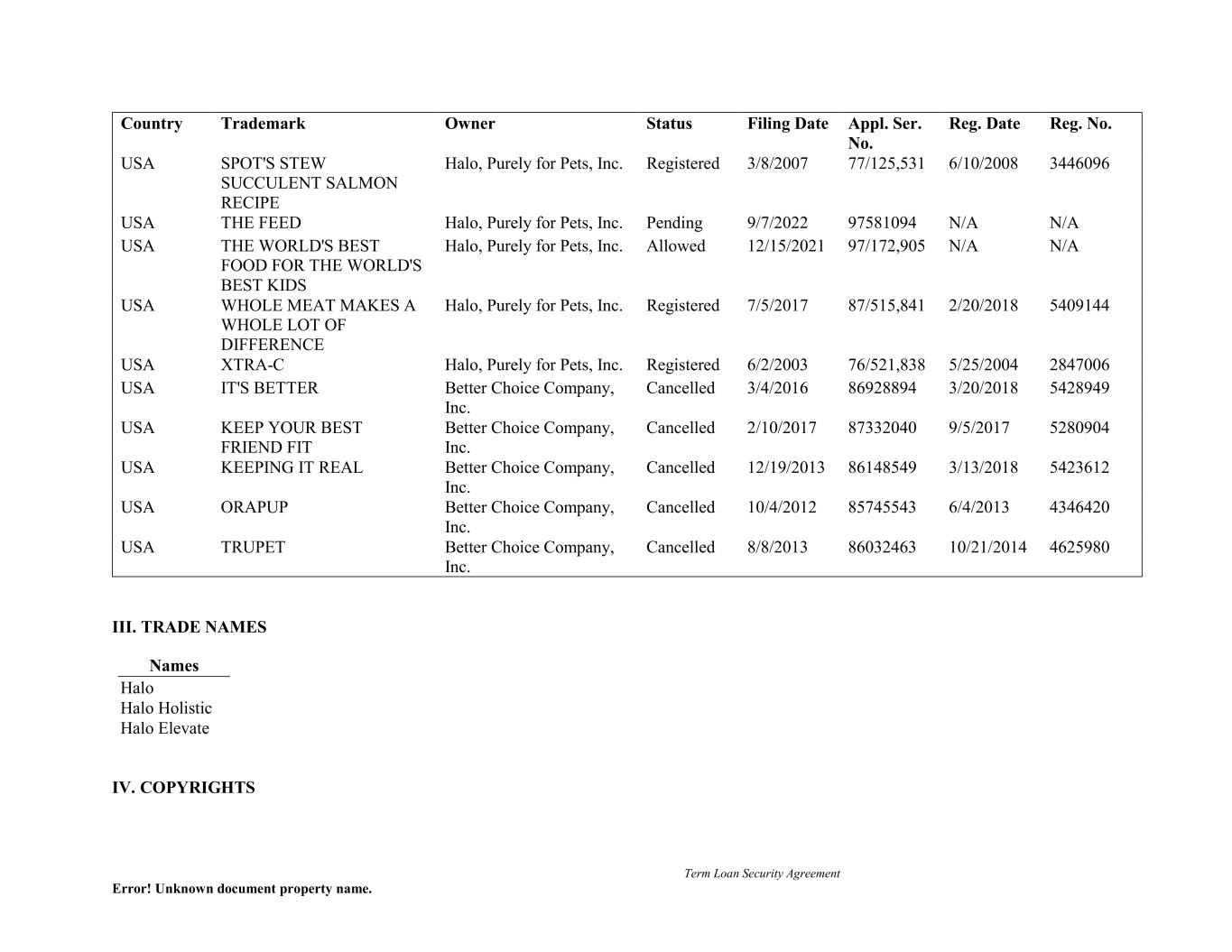

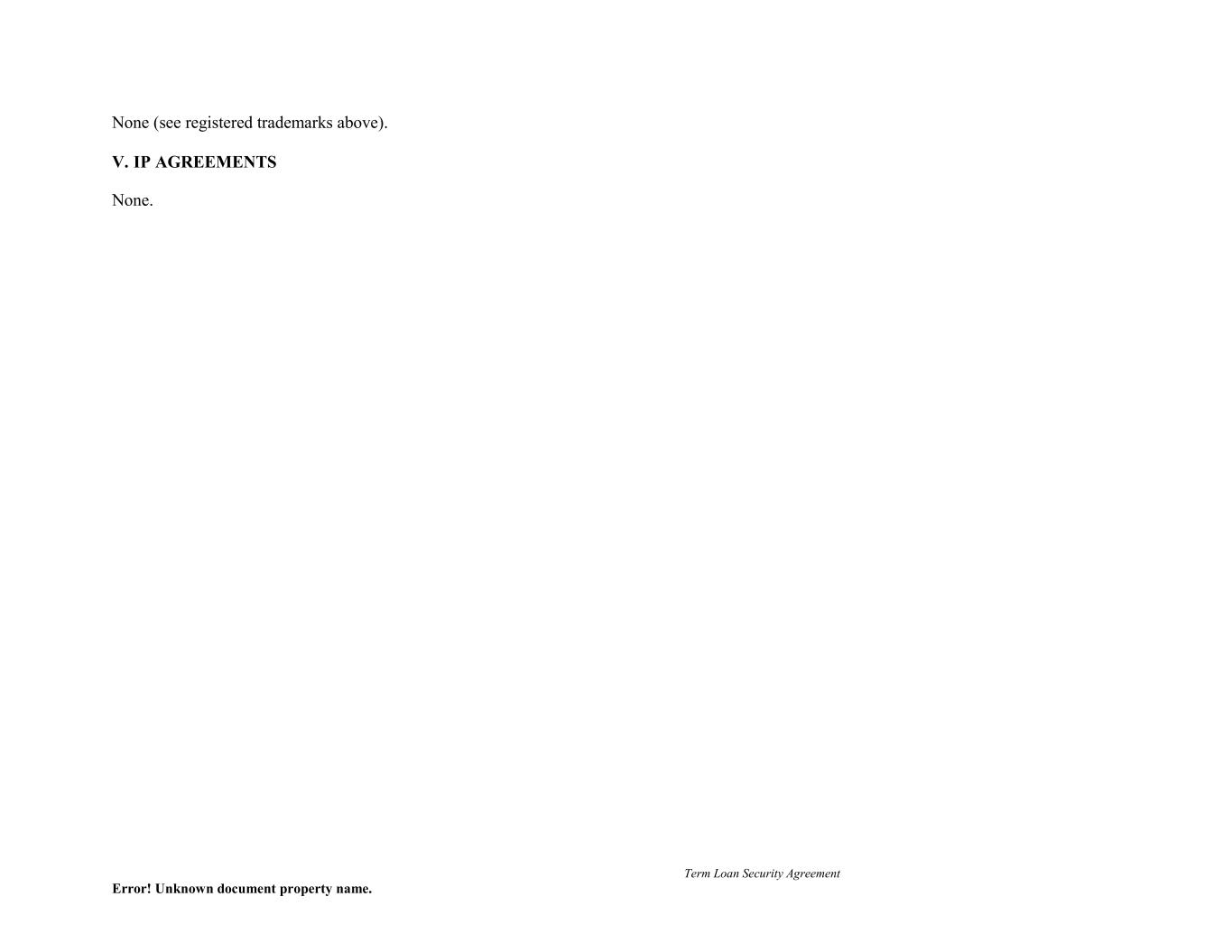

Term Loan Security Agreement Error! Unknown document property name. Schedule III to the Term Loan Security Agreement INTELLECTUAL PROPERTY I. PATENTS None. II. DOMAIN NAMES AND TRADEMARKS Domain Names: www.halopets.com www.trudog.com www.betterchoicecompany.com U.S. Trademarks: Country Trademark Owner Status Filing Date Appl. Ser. No. Reg. Date Reg. No. USA LOVE YOUR CAT'S LIFE Better Choice Company Inc. Registered 6/6/2017 87477430 1/12/2021 6245737 USA LOVE YOUR CAT'S LIFE Better Choice Company Inc. Registered 6/6/2017 87979609 3/5/2019 5693690 USA TRUDOG Better Choice Company Inc. Registered 8/8/2013 86032169 5/27/2014 4540604 USA LOVE YOUR DOG'S LIFE Better Choice Company Inc. Registered 6/14/2013 85959882 2/10/2015 4685423 USA CLOUD NINE Halo, Purely for Pets, Inc. Registered 4/29/2004 78/410,393 7/19/2005 2970425 USA CLOUD NINE HERBAL DIP Halo, Purely for Pets, Inc. Registered 9/20/1996 75/169,663 10/21/1997 2106939 USA DreamCoat (Stylized/Design) Halo, Purely for Pets, Inc. Registered 3/23/2018 87/846,700 9/11/2018 5561194 USA GARDEN OF VEGAN Halo, Purely for Pets, Inc. Registered 9/2/2016 87/159,411 10/31/2017 5325313 USA HALO Halo, Purely for Pets, Inc. Registered 8/5/1992 74/302,240 4/13/1993 1764019 USA HALO Halo, Purely for Pets, Inc. Registered 3/6/2007 77/123,050 11/20/2007 3338946